Do I Need Specialized Jewelry Insurance? Here’s How to Know For Sure

January 7th, 2021Insurance is a necessary, but sometimes intimidating consideration if you own any valuable fine jewelry or gemstones. Like any important financial decision, choosing the right protection for your prized possessions can be a daunting task. It’s not just a matter of if you should purchase coverage, but also finding the right coverage to suit your unique needs. Fear not! Reading this will arm you with all the information you need to make an informed decision regarding specialized jewelry insurance.

- Do I really need jewelry insurance?

- Where can I get a specialized jewelry insurance policy?

- What do I need to get a jewelry insurance quote?

- What are the different types of jewelry insurance policies?

- What’s the difference between Actual Cash Value and Replacement Cost policies?

- What should I look for in a jewelry insurance company?

- How much does specialized jewelry insurance cost?

- What’s a safety device, and can I get discounted jewelry insurance coverage?

Do I really need jewelry insurance?

Let’s start with the most basic decision: do you actually need jewelry insurance? To figure that out, ask yourself a few questions:

- Is my jewelry piece or collection worth more than $1,000?

- Can I afford to repair or replace this piece if it’s ever damaged or lost?

- Am I reluctant to wear good pieces because of a fear it will get lost or stolen?

- Would I be crushed if anything happened to my jewelry pieces?

If the answer to any of those is yes, then a jewelry insurance policy is probably right for you. The only time we might not recommend a policy is for smaller, less valuable pieces that you would feel okay parting with. Here’s a good rule of thumb: if it’s worth more than a week’s worth of your gross salary, it’s probably worth getting an insurance policy—even if it’s just for peace of mind.

Where can I get a specialized jewelry insurance policy?

There are two options when looking at purchasing a jewelry insurance policy. The most common option is to add your jewelry to your homeowners policy through a floater—a supplemental policy purchased along with homeowners or renters insurance (also called an insurance rider). Most basic homeowners insurance coverage protects you from some valuable losses, but only up to a certain amount of money and only for the limited perils covered by your homeowners policy. For some companies, that amount could be as little as $1,000 for any particular occurrence after the application of your deductible. By adding a floater, you can extend limits to your whole collection, and add covered perils specific to your jewelry.

Using your homeowners insurance company for jewelry insurance, however, definitely has its drawbacks. For starters, if you’re looking to insure an engagement ring, a homeowners company may insist that your fiancee is a resident of your household and listed on the policy. It’s not only laborious and time consuming to do that, it could also ruin the surprise.

More issues can arise with homeowners insurance companies during and after a claim. A homeowners insurance company could insist that any replacement claims happen at one of their network jewelers where they can control costs. The company may not permit you to use your own jeweler, who you trust, to replace your piece. Afterward , the homeowners insurance company will likely use that jewelry claim to either raise your whole homeowners premium rate or even cancel your policy.

Our suggestion is to skip your homeowners insurance company and get seperate jewelry insurance coverage from a reputable, specialized jewelry insurance company. A standalone policy will generally provide more comprehensive coverage than a homeowners floater, such as coverage for mysterious disappearance, accidental damage, and natural disasters—key perils oftentimes not covered by a typical homeowners policy, with or without a seperate jewelry insurance rider.. Additionally, standalone policies provide replacement cost (more on that later), may include preventative maintenance coverage, and can extend limits above the appraised value. Best of all, by separating your jewelry insurance line with a specialized carrier, you do not risk increasing your homeowners or renters insurance premium, or having your homeowners policy non-renewed or cancelled in the event of a jewelry claim.

What do I need to get a jewelry insurance quote?

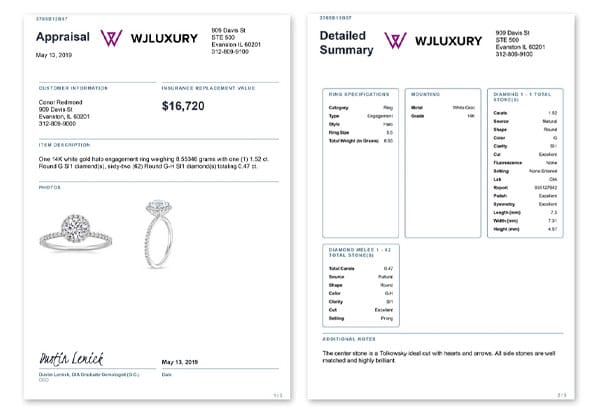

If you’ve ever bought fine jewelry or gemstones, your jeweler probably gave you an insurance appraisal. An insurance appraisal provides a detailed description of an item along with the approximate cost to replace it new with like kind and quality components and craftsmanship. Most jewelry insurance companies will require a detailed sales receipt or an appraisal if it’s a higher-valued item, and will typically require that appraisal to be recent, meaning the piece will have been professionally valued within the past two-to-three years. The insurance company may also request that you periodically update your appraisals. Keeping your jewelry and gemstone appraisals and jewelry insurance schedule up-to-date prevents you from becoming underinsured should you ever need to file a jewelry insurance claim in the future..

In addition to a recent jewelry appraisal, your jewelry insurance company will need some basic details about you, such as contact information, address, date of birth, etc. They may also request information about the person wearing the jewelry, if it isn’t being worn by you. The insurance company may ask you some routine questions to help you find additional savings as well as determine your risk profile, such as information about prior valuables claims, any criminal history, your occupation, and any safety devices installed in your home. Once an insurance company has all this information, they will be able to accurately assess the risk of providing you jewelry insurance coverage, along with the projected cost of an annual policy. Note, if an individual piece or collection is very expensive, the insurance company may have more questions about your lifestyle and financial wellbeing as part of their underwriting process.

What are the different types of jewelry insurance policies?

You should consider two key components of a jewelry insurance policy; whether it is a blanket or scheduled policy, and the settlement terms. This article largely focuses on scheduled policies, as they are the most common. This means that each item insured is described and quantified on your policy documents as separate line items in a “schedule”. A blanket policy doesn’t contain this breakout, but rather covers your collection up to a total limit. A blanket policy makes documentation a little less hectic, but costs significantly more than a scheduled policy. You’ll still need some documentation if you ever have a claim under a blanket policy.

Suggested Read: What is Insurance? An Intro to the Basic Types of Insurance

What’s the difference between Actual Cash Value and Replacement Cost policies?

More important than choosing a blanket or scheduled policy is reviewing the settlement terms of your coverage. It’s important to understand how the claims process works, and how much you will be compensated in the case of a claim. Most homeowners floaters offer something called an actual cash value policy. Actual cash value is advertised to pay either the cost to repair the item or replace the item new, minus depreciation. The advantage of this policy is its lower upfront premium. However, the disadvantage of actual cash value settlement is that you will rarely get enough money from your homeowners insurance to replace the item new with like kind and quality.

Standalone jewelry insurers usually offer replacement cost policies. The company will repair or replace the piece with a new piece of like kind and quality. While these policies are slightly more expensive, they ensure you are made whole in the case of a claim. That’s because they’re not beholden to depreciation cost. Whatever the current market cost of repairing or replacing your jewelry is what the insurance company will pay you in the event of a claim.

Far less common is a settlement type called agreed value. In the case of a total loss, the insurance company will pay you the stated value of the item of the policy. It’s the most generous policy as far as claims compensation goes, but you could pay 40% or more in higher premium for this policy type. Agreed value coverage is selected for high-end brand pieces (Harry Winston, Cartier, etc.) or antique pieces, as these are more difficult to replace with like kind and quality.

What should I look for in a jewelry insurance company?

Differences in coverage is a key concern when looking at insurance companies, but there are other factors to consider. First and foremost, make sure that you are working with a financially stable firm. AM Best conducts comprehensive financial reviews of insurance companies, and assigns them grades. We recommend using a company that is AM Best rated A- or better. We do not recommend using an insurance company with a Demotech rating, as these are commonly seen as less rigorous review and grading.

Secondly, make sure that you are working with an admitted insurance company. Admitted insurance companies have their products reviewed and approved by the insurance regulators in that state. Admitted insurance companies also participate in the state guaranty funds. This means if an insurance company ever goes insolvent, the guaranty fund will step in to pay all or part of your claim. Think of it like the FDIC, but for insurance companies.

How much does specialized jewelry insurance cost?

The short answer, Most folks can expect their annual jewelry insurance premium to fall between 1% to 2% of the appraised value of the piece of jewelry being insured. our jewelry the piece. Where you fall in the spectrum totally

The long answer, it depends on your unique risk profile. Although jewelry insurance rates and rating schema varies by company, there is some guidance we can give on price. In general, policyholders in urban areas pay more for jewelry insurance than policyholders in rural areas. This is because there are higher rates and density of jewelry-related crimes in urban areas, such as robbery, burglary, and theft, compared with crime statistics inn urban areas versus rural areas.

Policyholders in areas of the country with frequent natural disasters typically pay more for jewelry insurance than in other areas of the country. For example, this This includes states like Florida (hurricane and flood risk) and California (earthquake and wildfire risk). Insurance companies may also use factors such as age, occupation, insurance credit score, or prior valuables losses as well when determining individual rates for jewelry insurance coverage.

What’s a safety device, and can I get discounted jewelry insurance coverage?

The best way to save money on your jewelry insurance policy is to install a home safe and a central station burglar alarm. These safety devices can save you up 10% each year on your overall jewelry policy premium. A burglar alarm should also get you a discount on your homeowners premium as well. If you have pieces that you keep in a bank vault, such as family heirlooms or antiques, there are additional savings to be had. You can cover those pieces with a separate safety deposit box policy, which can provide discounts as high as 75%. It’s important to note that the safety deposit box policies come with limitations on the time those pieces can be taken outside the box, along with prior notice to the insurance company. We recommend a standard jewelry insurance policy for pieces kept outside of a safety deposit box for more than 10 days a year.

Also Check:

Bvlgari Jewelry Insurance | BriteCo Jewelry Insurance

How Do You Finance An Engagement Ring

David Yurman Jewelry Insurance | BriteCo Jewelry Insurance

Piaget Jewelry Insurance | BriteCo Jewelry Insurance

Tacori Jewelry Insurance | BriteCo Jewelry Insurance