How to Protect Your Most Precious Pieces, With Chopard Jewelry Insurance

Chopard Jewelry is a luxury brand that has produced exquisite jewelry pieces for over 160 years. The brand is known for its precise craftsmanship, use of precious stones, and innovative designs.

Suppose you are a proud owner of Chopard jewelry. In that case, you know how precious your piece is in monetary and sentimental value. Unfortunately, these high-value items are at risk of damage, loss, or theft, making investing in jewelry insurance a crucial part of caring for your Chopard jewelry collection.

Whether you are a longtime Chopard collector or have recently acquired a precious piece, understanding how does jewelry insurance work can ensure your treasured items are adequately protected. One of the ways to protect your piece is by getting engagement ring insurance if you have a valuable Chopard ring in your collection.

What You Will Learn

Chopard’s Luxurious History

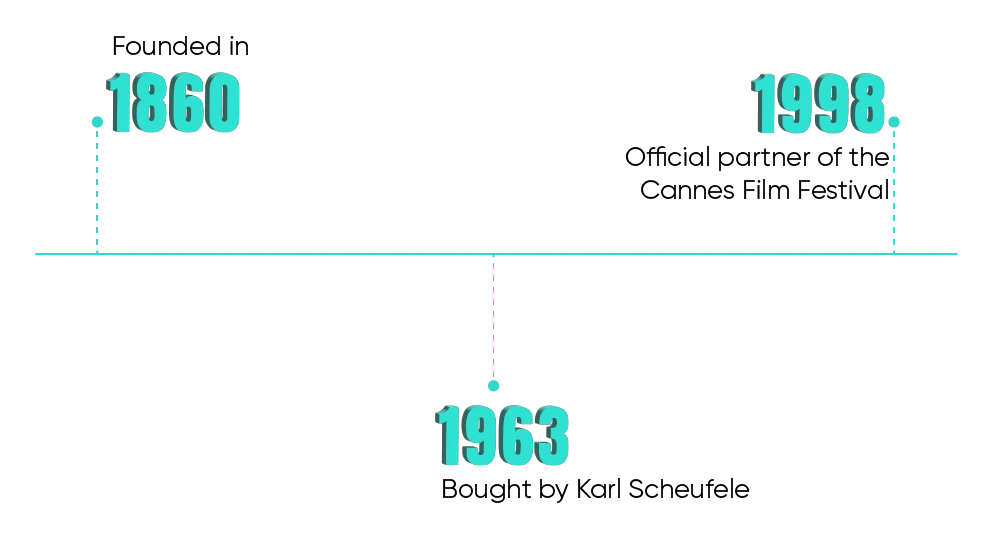

However, the company shifted its focus to jewelry and Chopard became a household name after Karl Scheufele, a German watchmaker, bought the company in 1963.

Under Scheufele’s leadership, Chopard became known for its exquisite craftsmanship, use of precious stones, and innovative designs. The brand gained even more recognition when it became the official partner of the Cannes Film Festival in 1998, creating iconic red-carpet moments with its stunning jewelry creations.

Today, Chopard continues to be a leader in the luxury jewelry and watch industry, with a reputation for impeccable quality and style. With its classic diamond pieces and bold, colorful designs, Chopard has remained a beloved brand for over a century.

Does My Chopard Jewelry Come with a Warranty?

Per the company’s policy, your Chopard jewelry or luxury watch comes with a limited, two-year warranty (from the original purchase date from an authorized Chopard dealer) against any manufacturing defects under everyday use. This means that if your Chopard watch exhibits any defects that are not a result of accidents or improper use, including movement, dial, hands, case, or bracelet issues, Chopard will repair or replace the watch free of charge within the two-year warranty period. If your Chopard jewelry experiences any defects related to metal, gemstones, or design issues, the company will likewise replace your jewelry at no cost.

However, manufacturer warranties and guarantees do not offer enough protection compared to jewelry insurance. The limited warranty only covers manufacturing defects, and does not cover damage arising from normal wear and tear, accidents, or improper use. Additionally, the warranty guarantee only lasts for a short period, leaving your precious Chopard jewelry vulnerable after the warranty period expires.

Purchasing jewelry insurance for your Chopard jewelry is essential to ensure comprehensive protection against loss, damage, mysterious disappearance, and theft. With jewelry insurance, you can have peace of mind knowing that your valuable piece is protected and that you can replace it if anything happens.

Homeowners’ Insurance vs. Jewelry Insurance

When insuring your Chopard jewelry, you may wonder whether your homeowners’ insurance policy is enough. While homeowners insurance or renters insurance cover jewelry, it often has coverage limits that can leave you underinsured in the event of loss or damage.

One limitation of homeowners insurance is the coverage limit. Most homeowners’ policies have a maximum limit for jewelry coverage, typically around $1,000 to $1,500. If your Chopard jewelry is worth more than this amount, your insurance company may not fully cover it. Furthermore, homeowners’ and renters’ insurance may only cover certain types of loss, such as theft or damage from a covered peril like fire or water damage.

In contrast, jewelry insurance specifically protects your valuable jewelry. It provides more comprehensive coverage than homeowners’ insurance, including coverage for loss or damage due to accidental loss, theft, damage, and more. Jewelry insurance can also provide coverage for the total appraised value of your Chopard jewelry, ensuring that you are fully protected.

Another significant difference between jewelry and homeowners insurance is that jewelry insurance covers mysterious disappearances, while homeowners insurance does not. Mysterious disappearance is when you simply cannot find your jewelry, and it is unclear how it was lost or misplaced.

With jewelry insurance, you can rest assured that your Chopard jewelry is covered no matter how it disappears. In contrast, homeowners insurance may not cover this type of loss.

How Much Does Chopard Jewelry Insurance Cost?

When insuring jewelry, the cost of coverage for your Chopard items can vary depending on several factors. Policy costs must go through an underwriting review and are subject to approval based on policy terms and conditions. Rates may vary based on factors such as the value of your jewelry and its primary location.

While the cost of insurance may seem unnecessary, replacing lost, stolen, or damaged jewelry out of your own pocket can be far more costly and stressful, especially for high-value items like engagement rings. Not insuring your jewelry can cost you even more in the long run.

The good news is that BriteCo jewelry insurance is an affordable way to get comprehensive protection for your Chopard pieces, with policies typically costing about 0.5-1.5% of the total value of your jewelry per year. For example, the price of Chopard engagement ring insurance would be $159 annually for a ring costing $10,600.

“BriteCo jewelry insurance is an affordable way to get comprehensive protection for your Chopard pieces, with policies typically costing about 0.5-1.5% of the total value of your jewelry per year.”

How to Insure Chopard Jewelry

You can insure your Chopard jewelry with BriteCo in a straightforward process, entirely online. Getting Chopard jewelry insurance works by following a simple step-by-step process on the BriteCo site:

- Get an Appraisal

The first step is to get a professional appraisal of your Chopard jewelry. This appraisal will help determine the value of your jewelry and ensure that you have the right amount of coverage. The best jewelry insurance companies require a professional appraisal for claims of loss, damage, theft, or mysterious disappearance. BriteCo makes getting a jewelry appraisal valuation easy and affordable. Our online appraisal service offers the simplest pricing with the most convenience. For only $26, you get a professional, certified appraisal valuation delivered by email and our appraisal valuations are guaranteed to be eligible for BriteCo insurance coverages. - Get a Quote

Once you have an appraisal, go to the BriteCo website and enter the value of your Chopard jewelry to get an instant quote with all the necessary details, including policy options and premiums. - Choose Your Coverage

BriteCo offers a range of jewelry insurance coverage options to fit your specific needs. Choose the one that best fits your requirements and budget.When insuring your jewelry with BriteCo, you can count on fast, affordable, and comprehensive 5-star rated coverage. BriteCo jewelry insurance covers your valuable items worldwide, 365 days a year, with no deductibles.We understand that accidents happen, so we cover all types of jewelry damage, including loss, theft, and mysterious disappearance. Our policies also include coverage for up to 125% of the appraised value, so you never have to pay extra for replacement. - Upload Documentation

To purchase coverage, you must upload the appraisal report and any other documentation, such as receipts, certificates of authenticity, or photos of your jewelry to the BriteCo website. - Pay Premiums

Finally, once you have selected your specialized jewelry insurance policy and uploaded the required documentation, you can pay your premiums online. BriteCo offers competitive rates and flexible payment options to make the process easy and affordable.

Maintaining Your Jewelry Insurance

With standard homeowners’ or outdated jewelry insurance policies, you must maintain your coverage by submitting new documentation year after year. This means appraising your pieces, filling out new policy papers, and communicating through time-consuming emails or phone calls to ensure your items are adequately covered.

With BriteCo, though, maintaining your jewelry insurance is easy. Instead of resubmitting all your documentation, BriteCo automatically updates your pieces’ value based on market changes for diamonds, platinum, gold, and other metals and gemstones.

With BriteCo, you won’t have to worry about losing your comprehensive coverage for your Chopard items just because you didn’t get the paperwork in on time. These yearly valuations will ensure your jewelry insurance covers 125% of your appraisal value based on the current conditions.

Protect Your Treasured Chopard Jewelry

When you own gorgeous, high-value pieces from a luxury brand like Chopard, you must protect them against loss, theft, or damage with jewelry insurance. BriteCo offers the best jewelry insurance coverage with worldwide coverage for your items at affordable prices.

With a quick, hassle-free appraisal and quote process, low monthly or annual premiums, and discounts for safe storage, BriteCo stands out above other jewelry insurance companies in terms of both pricing and convenience.

Our comprehensive coverage means you’ll never have to worry about replacing your missing or damaged items and, instead, have peace of mind that your pieces are protected no matter what. Get a quote today and get coverage for your Chopard jewelry.

Also Check:

David Yurman Jewelry Insurance | BriteCo Jewelry Insurance

Piaget Jewelry Insurance | BriteCo Jewelry Insurance

Graff Jewelry Insurance | BriteCo Jewelry Insurance

Engagement Ring History | BriteCo Jewelry Insurance

How Much Is Engagement Ring Insurance?