Piaget is a luxury jewelry brand known for its exquisite craftsmanship and high-quality materials. If you own Piaget jewelry, protecting your investment with specialty jewelry insurance is essential. With this coverage, you can avoid losing the full value of your fine jewelry in the event of theft, loss, or damage.

Specialty jewelry insurance explicitly covers the unique characteristics of high-end jewelry, such as the value of rare gemstones, diamonds or vintage Piaget pieces. Rather than taking a chance with your precious Piaget jewelry, you can give yourself peace of mind with the right insurance coverage.

What You Will Learn

The Piaget Brand

Piaget is a Swiss luxury jewelry and watch brand founded in 1874 by Georges Piaget. Initially, a small family business specializing in the production of watch movements, Piaget expanded its offerings to include jewelry in the mid-20th century.

The brand quickly gained a reputation for innovative designs and intricate craftsmanship, attracting high-profile clients such as Jackie Kennedy and Elizabeth Taylor. In the 1970s, Piaget became known for its ultra-thin watches, setting several world records.

In addition to their world-renowned designer watches, Piaget is known for their exquisite high jewelry collections, including diamond earrings. Some stand-out collections include Solstice, which pays tribute to the longest night of the year when gems sparkle brighter, and Wings of Light, inspired by Birds of Paradise. Piaget’s jewelry collections are characterized by their creativity, vibrant colors, bold designs, and the incorporation of precious stones and metals, such as rose and white gold.

Today, the brand is under new management by a luxury goods conglomerate Richemont and continues producing exquisite jewelry and timepieces beloved by collectors and fashionistas.

“Fine jewelry insurance covers a wide range of risks, including loss, theft, damage, and mysterious disappearance, giving you peace of mind that you can recover its value if something happens to it.”

Why You Need Fine Jewelry Insurance

Fine jewelry from Piaget is not just an accessory but also an investment. Protecting your jewelry is vital, whether it’s a family heirloom like a vintage Piaget watch or a piece purchased for a special occasion.

Fine jewelry insurance covers risks like loss, theft, damage, and mysterious disappearance. Knowing that your jewelry is protected and you can recover its value if something happens gives you peace of mind.

One of the main reasons to have fine jewelry insurance is that your standard homeowners’ or renter’s insurance policy may not provide adequate coverage for your Piaget jewelry. These policies typically limit the amount of jewelry coverage, typically around $1,500. These policies may not cover specific categories of loss or damage, such as mysterious disappearance.

Fine jewelry insurance covers a broader range of risks than loss or damage. It can protect you in case of theft, whether from your home or while traveling. It also offers coverage that matches or exceeds the piece’s appraisal value.

Another reason to have fine jewelry insurance is that it can help you avoid the emotional and financial impact of losing a cherished piece. Losing a piece of jewelry with sentimental value can be devastating, and fine jewelry insurance can help ease the burden by providing financial compensation to replace the piece.

How Piaget Jewelry Insurance Works

Jewelry insurance works similarly to other types of insurance policies. You pay a premium in exchange for coverage for your valuable jewelry in case of loss, damage, theft, or mysterious disappearance.

First, you’ll need to get your jewelry appraised. An appraisal is a crucial step, as it establishes the value of your jewelry and ensures that you’re getting the right amount of coverage. You can have your jewelry appraised by a professional jeweler or an independent appraiser.

The appraiser will assess the value of your jewelry based on the quality of the stones and metals, design, and condition of the piece.

If you have recently purchased your Piaget jewelry within the last 12 months, you can use your proof of purchase document to prove the piece’s value and receive an estimate for your premium.

Once you have your appraisal, visit BriteCo to shop for jewelry insurance policies. Use our simple online tool to get a quote and find a policy that meets your needs and fits within your budget.

When you’ve chosen a policy, you’ll need to provide BriteCo with a copy of your appraisal and pay your premium. Your policy will then go into effect, and you’ll be covered for any losses or damage that fall within the scope of your policy.

You’ll need to file a claim in the event of a loss. The claim includes providing documentation, such as a police report or a receipt for the jewelry, so that we can evaluate the claim and either provide compensation to repair or replace the jewelry.

“BriteCo offers transparent, affordable coverage with no hidden fees, and you can manage your policy online for added convenience.”

How to Apply for Fine Jewelry Insurance

Applying for fine jewelry insurance for diamond earrings, bracelets, rings, or watches is quick and easy. Visit the BriteCo™ website and fill out the online application form.

Provide basic information about yourself, including your name and contact details, and information about the jewelry you want to insure, such as the type of jewelry, its value, and any appraisals you have. You will receive a quote based on your piece’s value and location. Most of our policies cost between $4 and $12 per month and are .5% to 1.5% of the appraisal value.

For example, if you insure a Piaget diamond ring worth $25,000, you’d pay around $10 to $31 monthly for full coverage.

Once you’ve applied, a BriteCo representative will review it and contact you to finalize your coverage. You can choose how to pay for your coverage, monthly or annually, and explore discounts like safe storage or paying for yearly coverage.

BriteCo offers transparent, affordable coverage with no hidden fees, and you can manage your policy online for added convenience.

Piaget Jewelry Insurance FAQs

What should I look for in a jewelry insurance policy?

When shopping for a jewelry insurance policy, look for one that offers comprehensive coverage for loss, theft, and damage with no or low deductibles. It would be best if you also looked for a policy that provides coverage for the full replacement value of your jewelry and is backed by an AM Best A+ rated insurance carrier.

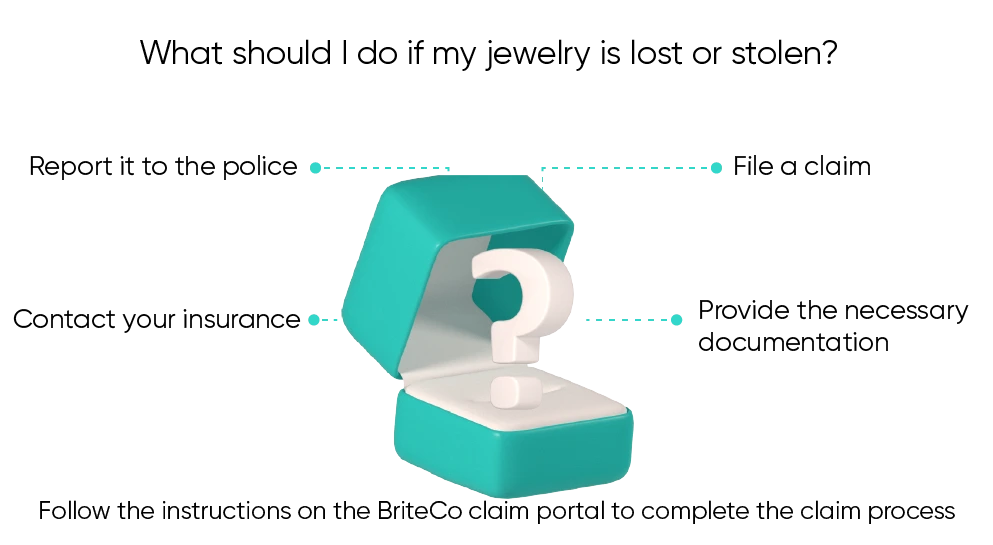

What should I do if my jewelry is lost or stolen?

If your jewelry is lost or stolen, report it to the police and contact your insurance company to file a claim. Provide the necessary documentation, such as a police report or appraisal, and follow the instructions on the BriteCo claim portal to complete the claim process.

Can I work with my own jeweler to replace my lost jewelry?

Some jewelry insurance companies have a preferred network that you and your jeweler may be required to use when obtaining a replacement stone, diamond, or piece of jewelry. While this may save the insurance company money, it may not accurately reflect the value of your jewelry. It could also cause complications if you or your jeweler are not satisfied with the quality of the preferred network’s products.

At BriteCo, we understand the importance of ensuring your satisfaction when replacing lost or damaged jewelry. That’s why we allow you to work with your preferred jeweler, whether they are local, family-owned, or an online retailer. We never require you to use a preferred network and strive to provide you with the highest quality replacement piece possible.

What is a jewelry insurance deductible?

A deductible is the amount of money you are responsible for paying out of pocket before your insurance provider covers the remaining cost. At BriteCo, we offer jewelry insurance policies with no deductible, meaning you won’t have to worry about any out-of-pocket expenses when replacing a lost or damaged item.

Also Check:

David Yurman Jewelry Insurance | BriteCo Jewelry Insurance

Graff Jewelry Insurance | BriteCo Jewelry Insurance

Chopard Jewelry Insurance | BriteCo Jewelry Insurance

Buccellati Jewelry Insurance | BriteCo Jewelry Insurance