Bvlgari is a renowned luxury jewelry brand that has been around for over a century. Their exquisite collection of jewelry pieces are known for their timeless beauty and exceptional craftsmanship. However, as with any valuable item, there is always the risk of loss, theft, or damage. Dedicated jewelry insurance ensures that your high-value Bvlgari jewelry pieces are protected.

What You Will Learn

Luxury Brand Bvlgari

Founded in 1884 in Rome by Greek jeweler Sotirios Bulgari (Voulgaris), the brand is a global phenomenon in over 50 countries. Bvlgari’s jewelry pieces are crafted with the finest materials and designed to be timeless works of art, often featuring geometrical shapes inspired by the Eternal City. Its collections include 18K gold, platinum, silver, and stainless steel pieces and precious gemstones like diamonds, pearls, malachite and turquoise.

The brand’s fine jewelry is the ideal accessory for a night on the town or adding some glam to a business day outfit. From a dazzling diamond ring to stunning earrings and bracelets, every piece of Bvlgari jewelry is a masterpiece crafted with the utmost attention to detail.

How Important is Jewelry Insurance?

Purchasing high-end jewelry is an investment, and protecting it with dedicated jewelry insurance is essential. Jewelry insurance provides you with financial protection if your precious jewelry or watches get lost, stolen, or damaged.

This is critical when it comes to luxury brands like Bvlgari, where the value of the jewelry can be worth thousands of dollars. Bvlgari jewelry insurance gives you peace of mind and allows you to enjoy your jewelry without worrying about potential risks.

What Does Jewelry Insurance Cover?

Jewelry insurance covers a wide range of risks that may cause damage or loss to your jewelry. This can include theft, loss, damage, or even natural disasters like floods or fires. Depending on the policy, insurance can cover the full value of your jewelry or a portion of it. Most insurance policies also require you to provide proof of purchase or an appraisal for the jewelry you want to insure.

Always ensure you read the policy thoroughly and understand what is covered and what is not. Some policies may have exclusions, such as loss or damage while traveling or leaving jewelry in an unsecured location.

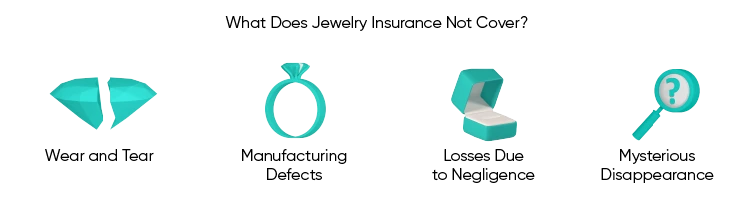

What Does Jewelry Insurance Not Cover?

While jewelry insurance covers a wide range of risks, some things are typically not covered by standard policies. It’s important to understand what your policy does not cover to ensure that you have adequate protection for your valuable pieces. Some standard exclusions in jewelry insurance policies include:

- Wear and tear: Most insurance policies do not cover damage due to normal wear and tear, such as scratches or dents resulting from regular use.

- Manufacturing defects: Most insurance policies will not cover your jewelry’s manufacturing defects because the manufacturer’s warranty covers them.

- Losses due to negligence: If you lose your jewelry due to negligence, such as leaving it in an unsecured location, the insurance policy may not cover the loss.

- Mysterious disappearance: If you cannot prove that your jewelry was lost or stolen, some providers may not cover it.

How Does Jewelry Insurance Work?

Jewelry insurance works similarly to other types of insurance policies. Follow these steps:

- Purchase a policy: Purchase jewelry insurance from a dedicated provider. While you can buy a policy from your current homeowners’ or renter’s insurance provider or add a rider, the coverage often won’t cover the replacement cost of high-end jewelry and accessories from brands like Bvlgari.

- Provide documentation: Once you have purchased a policy, you will need to provide documentation to the insurance provider. This typically includes a receipt or proof of purchase from the shop where you bought the piece, a jeweler’s professional appraisal of the item’s value, and photographs of the jewelry.

- Pay your premium: You will need to pay premiums for your policy, either monthly or annually. The cost of the premiums depends on the value of your jewelry and the type of policy you have. BriteCo jewelry insurance usually costs, on average, between .5% and 1.5% of the appraisal value of your jewelry a year.

- Make a claim: If your jewelry is lost, stolen, or damaged, you can file a claim with your insurance provider. You will need to provide evidence of loss or damage, such as a police report or photographs.

- Receive a replacement: If your claim is approved, your insurance provider may partner with a jewelry industry professional to replace or repair your piece. Some policies may provide full replacement value, while others may provide a percentage of the value.

Does Homeowners’ Insurance Cover Jewelry?

Homeowners’ insurance may provide limited coverage for jewelry. Some key things to know about how homeowners’ insurance covers jewelry include:

- Coverage limits: Homeowners’ insurance typically includes coverage for personal property, including jewelry. However, there are usually limits to how much coverage is provided for jewelry, typically ranging from $1,000 to $1,500. You may not be fully protected if your Bvlgari jewelry is worth more than the coverage limit.

- Deductibles: Homeowners’ insurance policies also typically have deductibles, which is the amount you must pay out of pocket before your insurance coverage kicks in. If your jewelry is lost, stolen, or damaged, you will need to pay your deductible before your insurance coverage provides any compensation.

- Exclusions: Homeowners’ insurance policies may also exclude certain types of losses, such as losses due to wear and tear or damage that occurs outside of your home.

- Additional coverage: If you have valuable jewelry that costs a higher price than the coverage limits of your homeowners’ insurance policy, you may need to purchase additional coverage or a separate jewelry insurance policy to ensure that you are fully protected.

Do I Need a Jewelry Appraisal?

When you purchase Bvlgari jewelry, you’ll receive a proof of purchase document sufficient to apply for jewelry insurance. However, if you inherited Bvlgari pieces or purchased vintage Bvlgari jewelry from a private seller, you need an appraisal for jewelry insurance.

Getting a jewelry appraisal from professional jewelers is integral to protecting your valuable jewelry and ensuring you have the right insurance coverage.

- Determine value: An appraisal provides an expert assessment of the value of your jewelry. This information is essential for determining how much insurance coverage you need to protect your investment adequately.

- Insurance requirements: Many insurance providers require an appraisal before providing coverage for your jewelry. An appraisal can provide the documentation you need to prove the value of your jewelry and ensure that you have the right coverage.

- Estate planning: If you plan to pass your jewelry down to future generations or include it in your estate planning, an appraisal can help you understand its value and ensure it is distributed according to your wishes.

- Selling or trading: If you plan to sell or trade your jewelry, an appraisal can help you understand its value and ensure that you get a fair price.

When getting a jewelry appraisal, choose an experienced and qualified appraiser specializing in jewelry. Look for an appraiser certified by a reputable organization, such as the Gemological Institute of America (GIA) or the American Gem Society (AGS).

An appraisal typically involves a detailed assessment of the jewelry’s characteristics, such as the quality of the gems and the metal, and an analysis of market trends and other factors affecting its value.

What you need to know about jewelry appraisals

Why Choose BriteCo™?

At BriteCo, we believe that everyone deserves access to jewelry insurance. We offer comprehensive jewelry insurance at an affordable price that gives you peace of mind. Our policies allow you to enjoy worldwide coverage for loss, theft, damage, and mysterious disappearance. We offer additional benefits such as safe storage discounts, monthly premium options, and coverage up to 125% of your item’s appraised value.

At BriteCo, our policies can be purchased online within minutes, and claims can be easily submitted on our website. We’re dedicated to providing you with the best possible customer experience, and we’re always here to help if you have any questions or concerns.

Contact us today to learn more about our coverage options, or use our online tool to get a quote for your insurance plan in minutes. With BriteCo, you can trust that your jewelry is protected by a reliable and trustworthy insurance provider.

Also Check:

David Yurman Jewelry Insurance | BriteCo Jewelry Insurance

Piaget Jewelry Insurance | BriteCo Jewelry Insurance

Tacori Jewelry Insurance | BriteCo Jewelry Insurance

Best Way to Sell Inherited Jewelry | BriteCo Jewelry Insurance