2023 was one of the worst years for natural and lab grown diamond prices in recent memory. Below we explore the price trends in natural and lab grown diamonds and why diamond prices have been so volatile in recent years.

What You Will Learn

Are diamond prices rising or falling?

Over the past year, natural diamond prices have fallen by 24.13% to an average price of about $4,000 for 1 carat natural diamonds. Meanwhile, lab grown diamond prices fell by -59.65% to $2,700 for 3 carat lab grown diamonds.

Why did natural diamond prices fall in 2023?

While lab-grown diamond prices tend to fall over time historically, the decline in natural diamond prices was a reversal of the long-term trend. Natural diamond prices generally increase over time due to inflation and supply/demand dynamics, making it a relatively stable asset class.

The primary reason for the steep decline in natural diamond prices in 2023 was that prices reverted to pre-pandemic levels. At the beginning of the COVID-19 pandemic, natural diamond prices initially tumbled 11% alongside US stocks and real estate.

Natural diamond prices fell significantly in 2023.

However, by the spring of 2022, a combination of high demand and limited supply led diamond prices to appreciate an eye-watering 44%. While experiences like travel, concerts, and sporting events were primarily put on hold during the first year of the pandemic, consumers splurged on luxury goods such as diamond jewelry. The limited supply of natural diamonds caused by supply chain issues in India (where most diamonds are cut and polished) further amplified the rising prices of natural diamonds.

The dramatic rise in prices for natural diamonds finally peaked in March of 2022, and prices fell a staggering 40% before bottoming in October 2023.

Why are natural diamond prices rising in 2023?

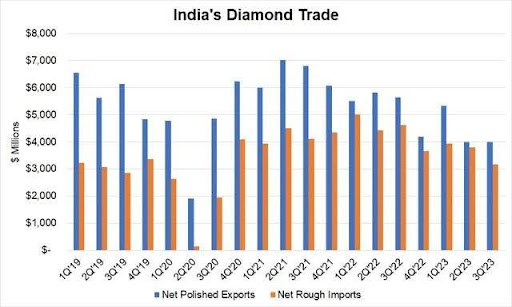

As of late December 2023, natural diamond prices have rebounded by about 11% from their October 2023 lows. This stabilization in diamond prices can be partially attributed to India’s freezing of diamond imports for two months beginning October 15th. India is the world’s largest producer of polished diamond exports, so by freezing diamond imports into the country, India is limiting global diamond supply and thus putting upward pressure on natural diamond prices.

Source: Avi Krawitz (avikrawitz.com); based on data from India’s Gem & Jewellery Export Promotion Council (GJEPC).

Why did lab-grown diamond prices fall in 2023?

Lab-grown diamond prices have generally fallen over time as the technology and techniques used to produce lab diamonds have improved, and competition among manufacturers has increased. 2023 was no different, with lab-grown diamond prices continuing to decline rapidly. Lab-grown diamond prices are now 96% lower than natural diamond prices in some categories, according to StoneAlgo’s diamond price calculator.

Will diamond prices rise or fall in 2024?

Recent history shows that natural and lab-grown diamond prices are volatile and unpredictable. After a historically poor year for natural diamond prices in 2023, it is possible that natural diamond prices will rise in 2024 due to a combination of supply-side constraints in India, new G7 regulations against importing diamonds from Russia, and an increased likelihood of rate cuts by the United State’s Federal Reserve. Lab-grown diamond prices have consistently fallen for years and don’t stop anytime soon. That said, if 2024 is anything like the past few years, it wouldn’t be surprising if the trends in natural or lab-grown diamond prices defy expectations.

Also Check:

How much is a Blue Diamond Worth? | BriteCo Jewelry Insurance

Largest Diamond in the World | BriteCo Jewelry Insurance

Heart Cut Diamonds: Love in Every Facet

The ‘80s Jewelry Trends Your Wardrobe Needs Now

The ‘70s Jewelry Trends To Add To Your Wardrobe Now