An insurance premium is the amount of money that a person or business pays for an insurance policy. It is a form of payment made to an insurance company to provide coverage for a specified period of time. The premium is based on factors such as the type and amount of coverage, the age and health of the person or business, and the perceived risk of the policyholder.

Insurance Policy Fundamentals

To understand an insurance premium, we need to start at the beginning and feel confident about . Insurance policies can cover many events, including auto accidents, medical expenses, personal property damage, and business losses. The policy itself consists of a contract between an insurance company and an individual or business in which the insurer agrees to provide financial compensation in the event of certain specified losses or damages. The policyholder pays a premium to the insurance company in exchange for this protection.

The policy’s terms and conditions include types of losses or damages covered, amount of insurance provided, deductible amount (amount of money the policyholder must pay out of pocket before the insurance company will pay a claim), and any exclusions or limitations that might apply. Depending on the policy, the insurer may also be responsible for providing legal defense if the policyholder is sued for damages related to an incident covered by the policy.

What You Will Learn

How Do Insurance Companies Determine Premiums?

When it comes to insurance companies determining premiums, the process is relatively complex. First, the insurance company will assess the risk associated with coverage for a particular person or group. This assessment has various factors, such as the person or group’s age, health, location, driving record, claims history, and others. The insurance company will use this data to determine the likelihood of the person or group filing a claim and the cost of providing coverage.

Next, the insurance company will use this information to calculate the premium for the policy. Factors such as type of coverage, deductible, and coverage amount are the basis of determining the total payment amounts. The insurance company will then adjust the premium based on how much risk they take and the coverage cost.

Finally, the insurance company will review and adjust the policy if necessary. This review may include changing the deductible, increasing or decreasing the coverage limits, or adding or removing specific options. Once the policy is finalized, the insurance company will then set the premium for the policy. The process of determining premiums can vary between insurance companies. Still, the overall goal is to choose a rate that will cover the cost of providing the policy while still providing the insured with an affordable rate.

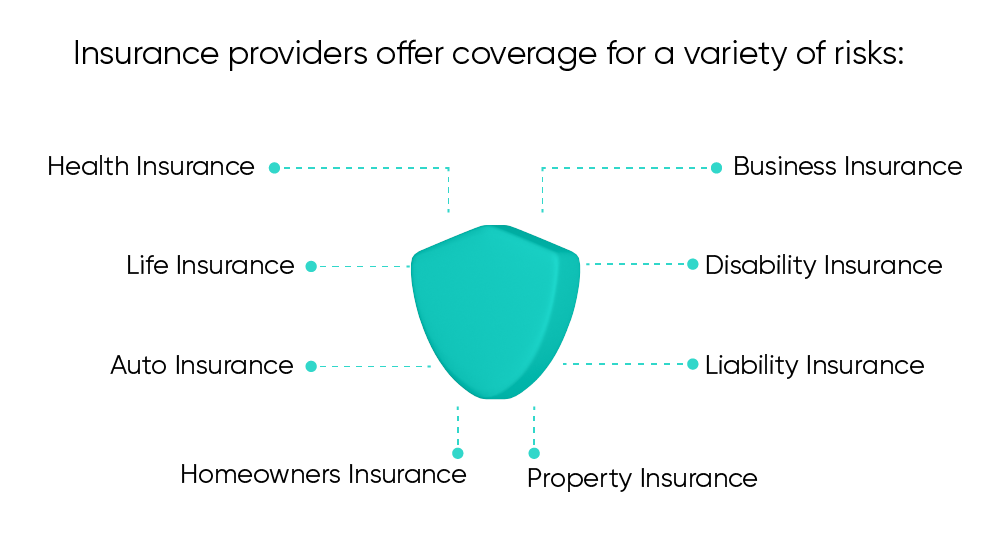

What Does an Insurance Company Cover?

- Health Insurance – Health insurance helps cover the cost of medical care, including doctor visits, hospital stays, and other medical expenses.

- Life Insurance – Life insurance provides a lump-sum payment to beneficiaries upon the insured individual’s death.

- Auto Insurance – Auto insurance covers the cost of damage to a vehicle caused by an accident or other incident.

- Homeowners Insurance – Homeowners insurance provides financial protection in the event of a disaster or other loss to a home, such as a fire or theft.

- Property Insurance – Property insurance covers the cost of damage to property, such as a house or car, caused by an accident, theft, or other incidents.

- Liability Insurance – Liability insurance covers the cost of damages caused by an individual’s negligence or carelessness.

- Disability Insurance – Disability insurance provides financial protection to individuals who cannot work due to an illness or injury.

- Business Insurance – Business insurance covers the cost of damages to a business caused by an accident or other incident.

- Travel Insurance – Travel insurance provides financial protection for travelers during an illness, accident, or other unexpected traveling events.

- Pet Insurance – Pet insurance helps cover the cost of veterinary care for a pet in case of an accident or illness.

- Specialty Jewelry Insurance – Specialty jewelry insurance provides cash or replacement for luxury jewelry and watches caused by loss, theft, or damage. Also known as personal jewelry insurance, it is designed for coverage of high value jewelry pieces. Possible infographic that highlights the types of insurance. Label only no descriptions.

What are Policy Coverage Limits?

Insurance policy coverage limits refer to the maximum amount of money an insurance company will pay for a claim. These limits are usually specified in the insurance policy and may differ for each coverage type. Understanding your policy limits is essential, as it will help you figure out how much you must pay out of pocket if you have to make a claim. Insurance companies may also have deductibles, which you must pay before the insurance company pays out any claims.

Understanding your Deductibles

A deductible is the amount of money the insured must pay out of pocket before the insurance policy begins to cover the costs of any claim—generally, the higher the deductible, the lower the insurance premium. Deductibles can apply to all insurance policies, including auto, health, home, and life insurance.

The following are key elements to understanding deductibles:

- A deductible is an agreed upon amount to pay before the insurance company covers a claim.

- The higher the deductible, typically the lower the insurance premium cost.

- Not all insurance policies have deductibles.

In an auto insurance policy, the deductible is usually a set amount to pay before the insurer pays out on any claim. For example, suppose the policyholder is involved in an accident and has a $500 deductible. In that case, they must pay the first $500 of the claim before the insurance company covers the remaining costs. In a health insurance policy, the deductible is the amount to pay before the insurance company begins to cover the costs of covered services. For example, if the policyholder has a deductible of $2,000, they must pay the first $2,000 of expenses before the insurer covers the remaining costs.

In a home insurance policy, the deductible is the amount to pay before the insurance company begins to cover the costs of any damage or loss to the home. For example, if the policyholder has a $1,000 deductible, they must pay the first $1,000 of any claim before the insurance company covers the remaining costs. A life insurance policy pays the deductible before the insurance company pays out any death benefits. Generally, life insurance policies do not have deductibles.

Suggested Read: What Is a Deductible in Insurance? | BriteCo Jewelry Insurance

Your Insurance Account Statement

An insurance account statement is a document issued by an insurance company to its policyholders at regular intervals, typically quarterly or annually. It outlines the amount paid in premiums, any claims paid to the policyholder, and the remaining balance in the policyholder’s account. It also contains other important information about the insurance policy, such as its terms and conditions, the type of coverage provided, and the insurance company’s contact information. The insurance account statement may also include any recent changes to the policy, such as increased premiums or new coverage options.

Insurance Premiums Key Takeaways

An insurance premium is a set amount of money paid to an insurance company in exchange for coverage under an insurance policy. Insurance companies are responsible for setting the premiums for their policies, and coverage limits can vary between providers. The premium or account statement will indicate how much the insurance company covers the policy and any applicable deductibles. Health insurance, car insurance, and homeowners insurance are all insurance policies. Most insurance companies also offer life insurance policies, which are typically more expensive than other types of coverage. Insurance providers also provide different types of coverage, such as liability, rental, travel and jewelry insurance. The deductibles associated with these policies may vary between insurance providers.

FAQs

Need just the basic rundown? Take a look for quick answers.

What is an insurance premium?

An insurance premium is the amount of money that a person or business pays for an insurance policy.

What does an insurance company cover?

Health, home, auto, disability, liability, life, business, jewelry, and pet insurance are some of the major forms of insurance.

What is a deductible?

A deductible is the amount of money you must pay out of pocket before the insurance policy covers any claim—often, the higher the deductible, the more it will lower the insurance premium.

What is an insurance account statement?

Issued at regular intervals, an insurance account statement outlines the amount paid in premiums, any claims paid to the policyholder, and the remaining balance in the policyholder’s account.

Do you Truly have all the Insurance you Need?

You don’t want to make the mistake of not having insurance when you need it for your car or health. The same goes for your fine jewelry.

BriteCo can help fill in the gaps in your existing insurance. We offer comprehensive coverage for your fine jewelry, engagement rings, and luxury watches, whether at home or traveling or in the event of theft, loss, damage, or even mysterious disappearance. See why our 5-star rated jewelry insurance policies give you better coverage at a better price, and get your quote today.

Also Check:

Jeweler’s guide to insurance payment suspensions by state