In a world where financial markets can be as unpredictable as they are enticing, the appeal of precious metals, particularly gold, has endured throughout the centuries. As investors seek to diversify their portfolios and safeguard their wealth, the question often arises: Is gold jewelry a good investment?

Let’s take an in-depth look at the appeal of gold jewelry as an investment, explore its value, and discuss the various factors that influence gold’s worth.

What You Will Learn

Why is Gold Jewelry a Good Investment?

Gold has played a pivotal role throughout history as a traditional store of value. The intrinsic qualities of gold, such as its scarcity, durability, and malleability, have contributed to its appeal as a precious metal.

Unlike other forms of gold, such as coins or bars, gold jewelry represents a harmonious blend of craftsmanship and intrinsic value. When contemplating whether gold jewelry is a good investment, it’s important to understand the nature of this precious metal in the context of wealth preservation.

Historic Trends in Gold Prices

Examining historical trends in gold prices provides valuable insights into the metal’s performance as an investment.

Over centuries, gold has experienced periods of price volatility, often influenced by economic, geopolitical, and market factors. Gold’s purchase price has exhibited both short-term fluctuations and long-term trends. The World Gold Council, a leading authority on gold, has meticulously documented these trends, shedding light on the metal’s resilience amid changing financial landscapes.

So, what do the trends say? Historical data reveals that gold has acted as a hedge against inflation and currency devaluation, making it an attractive option for investors seeking stability in their investment portfolios. However, understanding the factors driving gold price movements and gold futures is essential for individuals contemplating whether gold jewelry is a good investment for them personally.

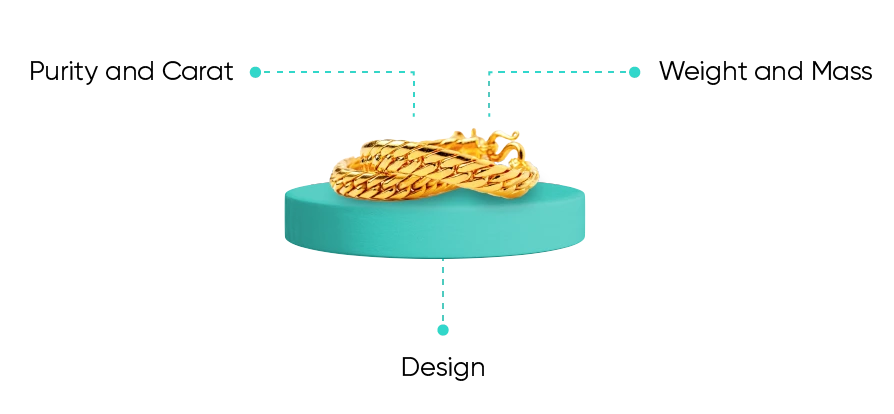

Factors Influencing the Value of Gold Jewelry

What makes one piece of gold jewelry more valuable and a better investment than another? There are several key considerations.

- Purity and Carat

Investing in gold jewelry involves purchasing gold jewelry pieces that typically contain a percentage of pure gold, measured in carats. This distinction in carats, whether 24k, 18k, or lower, directly influences the value and durability of the jewelry.

- Weight and Mass

The weight of gold jewelry significantly impacts its value. Buyers interested in gold jewelry as an investment opportunity should prioritize pieces with substantial weight. The combination of weight and purity determines the piece’s overall gold content and, consequently, the potential investment return.

- Design

While gold’s intrinsic value is important, the design and craftsmanship of the jewelry also play a role in its investment appeal. High-quality craftsmanship, intricate designs, and the inclusion of diamonds, emeralds, or other precious stones enhance the piece’s aesthetic and value.

This dual nature of gold jewelry, as both an investment and a form of expression, distinguishes it from other forms of gold investment, such as gold bullion or coins.

Pros and Cons of Gold Jewelry Investment

Gold jewelry is a compelling investment choice. However, navigating potential market volatility and liquidity concerns adds nuanced considerations.

Pros of Investing in Gold Jewelry

Portability and Storage: Unlike larger investments like real estate, gold jewelry is compact and can be securely stored in a small space, making it a practical choice for those who prioritize convenience.

- Diversification of Investment Portfolio: Including gold jewelry in an investment portfolio provides an effective means of diversification. Diversification is key to managing risk, and gold’s historical independence from traditional financial markets makes it a valuable asset, potentially offering a hedge against economic uncertainties.

- Dual-Purpose: Gold jewelry uniquely combines financial value with aesthetic appeal. Beyond its investment merits, gold jewelry serves as a wearable art form, allowing investors to enjoy both the financial benefits and the visual pleasure of their investment.

- Heirloom Potential: Gold jewelry often holds sentimental value, passed down through generations as family heirlooms. This emotional significance adds an extra layer of value beyond the intrinsic worth, making gold jewelry an investment that transcends mere financial considerations

Cons of Investing in Gold Jewelry

- Challenges in Selling: While gold jewelry is a tangible asset, its liquidity is limited compared to other forms of gold investment, like coins or gold bars. Selling jewelry might involve challenges such as finding the right buyer or facing potential deductions for craftsmanship and design.

- External Factors Affecting Purchase Prices: Prevailing gold prices are subject to market fluctuations influenced by global economic conditions, geopolitical events, and other external factors. Investors in gold jewelry must be prepared for the inherent volatility in the precious metals market.

- Wear and Tear on Jewelry: Unlike other forms of gold investment, gold jewelry is susceptible to wear and tear. Regular use can lead to scratches or other damage, potentially affecting the overall value of the piece.

While gold jewelry offers unique advantages as a tangible investment, potential challenges such as limited liquidity and susceptibility to market fluctuations should be carefully considered when evaluating whether gold jewelry is a good investment.

Comparing Gold Jewelry with Other Investments

Before you purchase gold jewelry as an investment, consider how it compares to other forms of precious metal investments, such as gold and silver bars, gold and silver bullion, and even silver jewelry options.

The main points to consider are:

- Unlike gold coins and bars, valued primarily for their pure gold content, gold jewelry encompasses the intrinsic value of the precious metal and the craftsmanship involved in creating a wearable piece of art. While many investors often buy gold bullion with the sole purpose of being a store of value, gold jewelry serves a dual function as both an investment and an aesthetic accessory.

- The World Gold Council acknowledges that gold’s appeal as an investment is rooted in its role as a precious metal. This aspect is shared with other precious metals such as silver, and fine jewelry incorporating precious stones adds a layer of value.

- In terms of purity, gold and silver bars may boast higher levels of precious metal than some jewelry investment pieces. However, high quality jewelry made from pure gold and silver remains a valuable asset.

Gold Jewelry vs. Silver Jewelry

Gold’s higher market value makes it an appealing choice for those seeking aesthetic enjoyment and a potentially higher return on investment.

Silver jewelry, on the other hand, is often considered more accessible and affordable. Silver’s lower market value makes it an entry point for investors looking to diversify their portfolios without committing to gold’s higher cost. That said, it’s important to note silver’s market dynamics may be subject to greater volatility.

The choice between investing in gold or silver jewelry depends on individual financial goals, risk tolerance, and personal preferences.

FAQs

Is buying gold jewelry a good investment?

Yes, investing in gold jewelry is a good choice. Gold historically preserves value, acts as a hedge against inflation, and combines aesthetic appeal with a tangible asset.

Why invest in gold jewelry?

Investing in gold jewelry provides a unique mix of aesthetic enjoyment and financial security. Gold is a stable asset, offering a timeless investment that combines fashion and usability with potential long-term gains.

Protect Your Investment

When shopping for gold investment jewelry, don’t forget to safeguard your assets. BriteCo offers reliable, cost-effective jewelry insurance covering loss, theft, and damage. You’ll rest easy knowing your jewelry portfolio is fully protected.

Contact us today or use our online tool to receive a personalized quote and find out more about our comprehensive coverage options.

Also Check:

What is the Largest Gold Nugget Ever Found?

What to Do with Old Jewelry: 4 Creative DIY Ideas

Is Jewelry an Asset? | BriteCo Jewelry Insurance