Pandemic-Driven Digital Transformation Changes Everything

In 2020, a group of jewelry industry leaders joined forces to study the digital transformation of retail jewelers by conducting a survey at the beginning of the COVID pandemic. The result was a first 2020 State of Jewelers Going Digital Report.

A second survey was conducted in March/April 2022 among retail jewelers sponsored by BriteCo, GemFind, Polygon, IGS, Women’s Jewelers Association (WJA), and Instore magazine. This report is based on the results of our 2022 survey.

It encompasses a period when jewelers ramped up their digital presence in response to pandemic closures and saw record sales increases from customers deprived of spending on travel and restaurants.

As retail jewelers brace for a slowdown in sales with customers traveling and dining out more while battling inflation, this report can help provide insights into what has occurred this past year—and how we might prepare for the immediate future.

By:

Dustin Lemick (Founder & CEO BriteCo)

Sean Lemire (General Director, Polygon)

Alex Fetanat (Founder & CEO, GemFind)

Seth Rosen (Owner, International Gem Society (IGS))

Jennifer Markas (Executive Director, Women’s Jewelers Association)

Trace Shelton (Editor, Instore Magazine)

Introduction

A coalition of leading retail jewelry providers and professional organizations has surveyed the industry landscape to get a clearer picture of how jewelers are managing the digital transformation of their sales and marketing operations accelerated by the demands of a global pandemic.

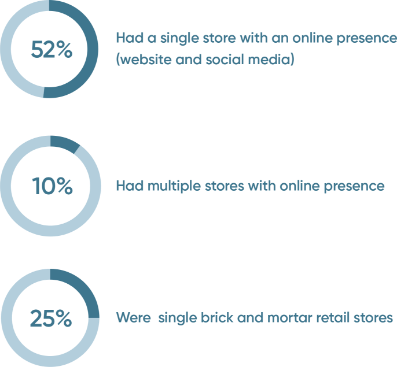

Among more than 300 responses, 125 retail jewelers from throughout the U.S. completed the survey. Of those respondents, more than half or 52% had a single store with an online presence (website and social media), and 10% had multiple stores with online presence. Nearly a quarter of respondents, or 24%, were single brick and mortar retail stores.

The impact of COVID-19 has made the transition to digital marketing among retail jewelers a necessity to remain competitive. However, the vast majority of retailers still rely on in-store visits as their primary sales channel—and surveys show that most customers still prefer to buy in person at retail. That’s why online jewelry sellers are expanding their brick and mortar presence by opening retail showrooms around the country

While the COVID pandemic and its aftereffects continue to accelerate the digital transformation of the jewelry industry, retail jewelers must learn to leverage technology both online and in-store if they are to survive and thrive into the next decade. “Digital or die” could well be the mantra among retail jewelers for the immediate future.

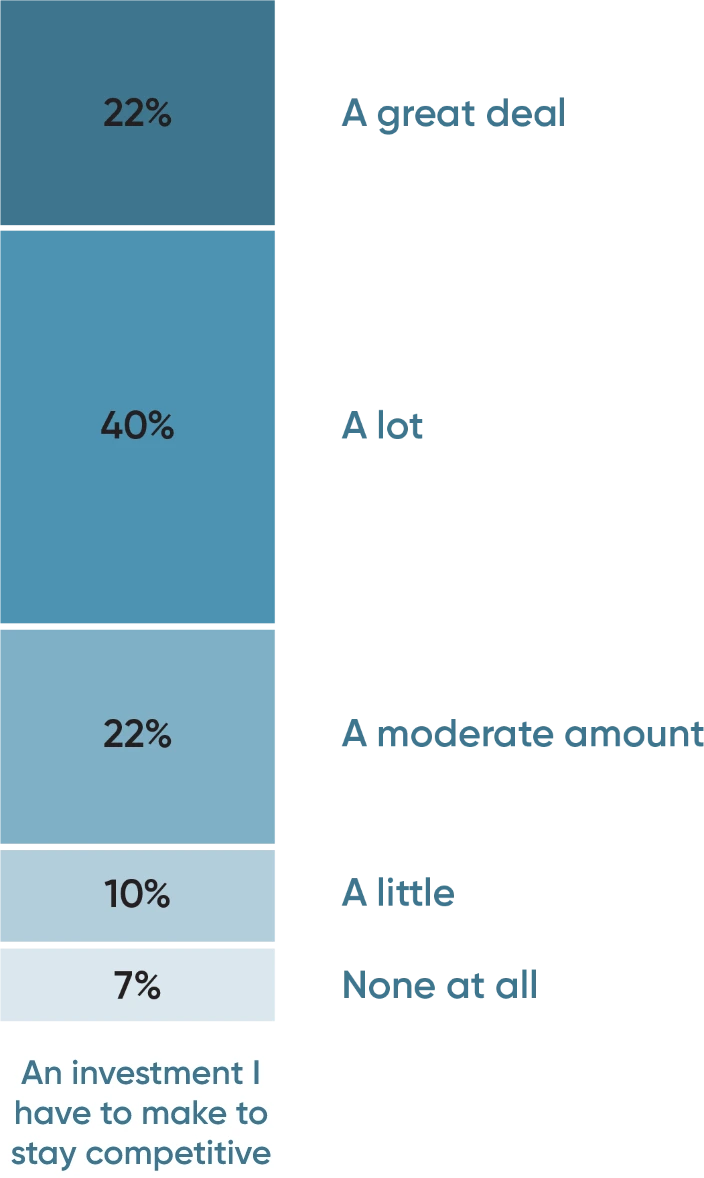

Nearly two-thirds (62%) of retail jeweler respondents said they have to invest in digital technology to remain competitive.

Table of Contents

We organized responses for this report into three sections:

PART-1

The impact of digital technology for retail jewelers during the sales boom of 2021

PART-2

How the use of digital technology has changed over the past year plus

PART-3

How digital technology is impacting store operations

PART-4

Characteristics of retail stores with higher sales

PART-1

Impact Of Digital Technology During Post Covid Lockdown Sales Boom

It’s no secret that sales have increased substantially for retail jewelers in the aftermath of the COVID pandemic. While lockdowns and store closures were generally unknown for the 2021 November to December holiday season, the Omicron variant was still very much an influence into 2022.

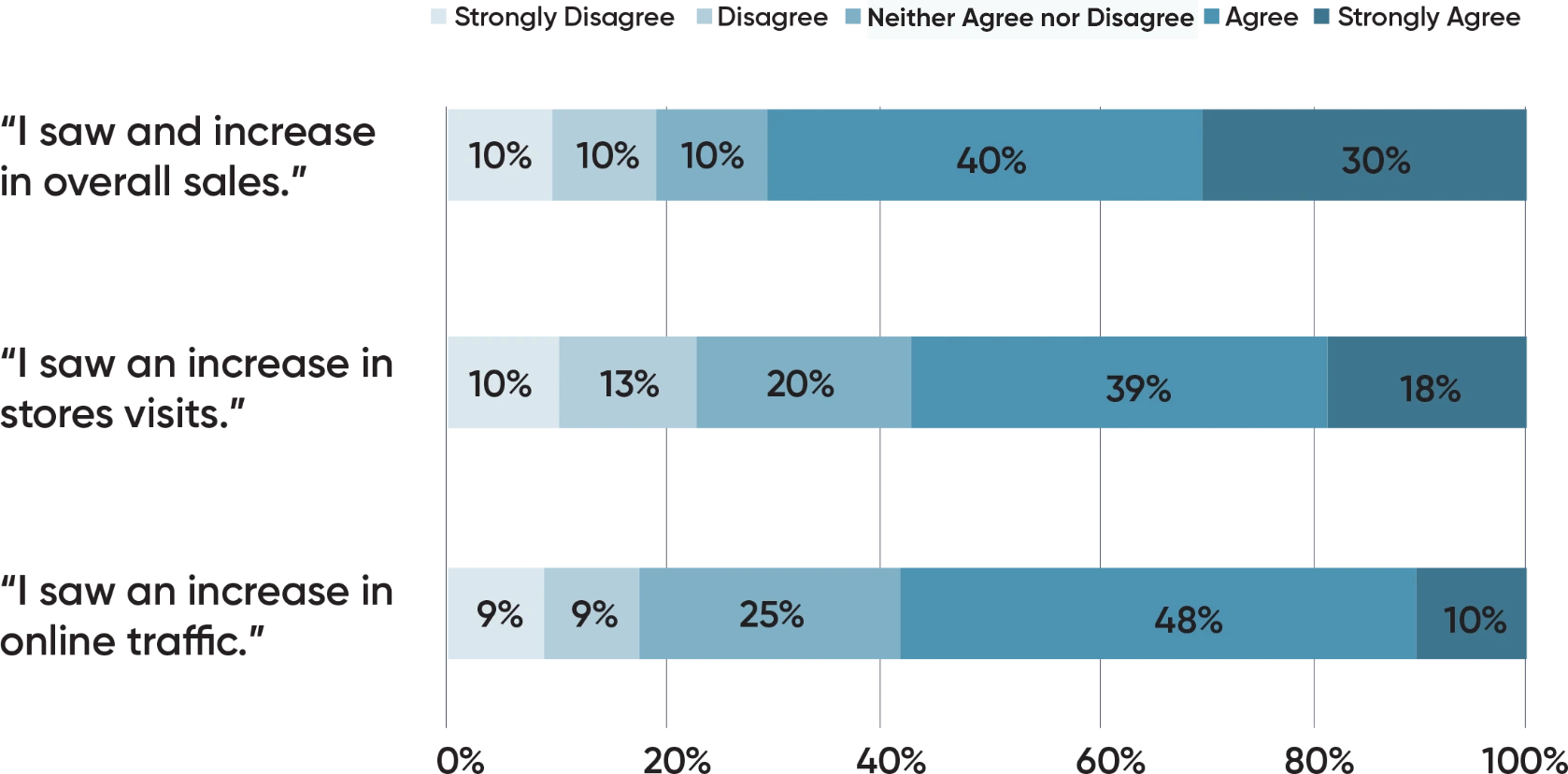

Retailers experienced a strong upward trend in overall sales during the last Nov-Dec Holiday Season, while both online and in-store sales remain pivotal.

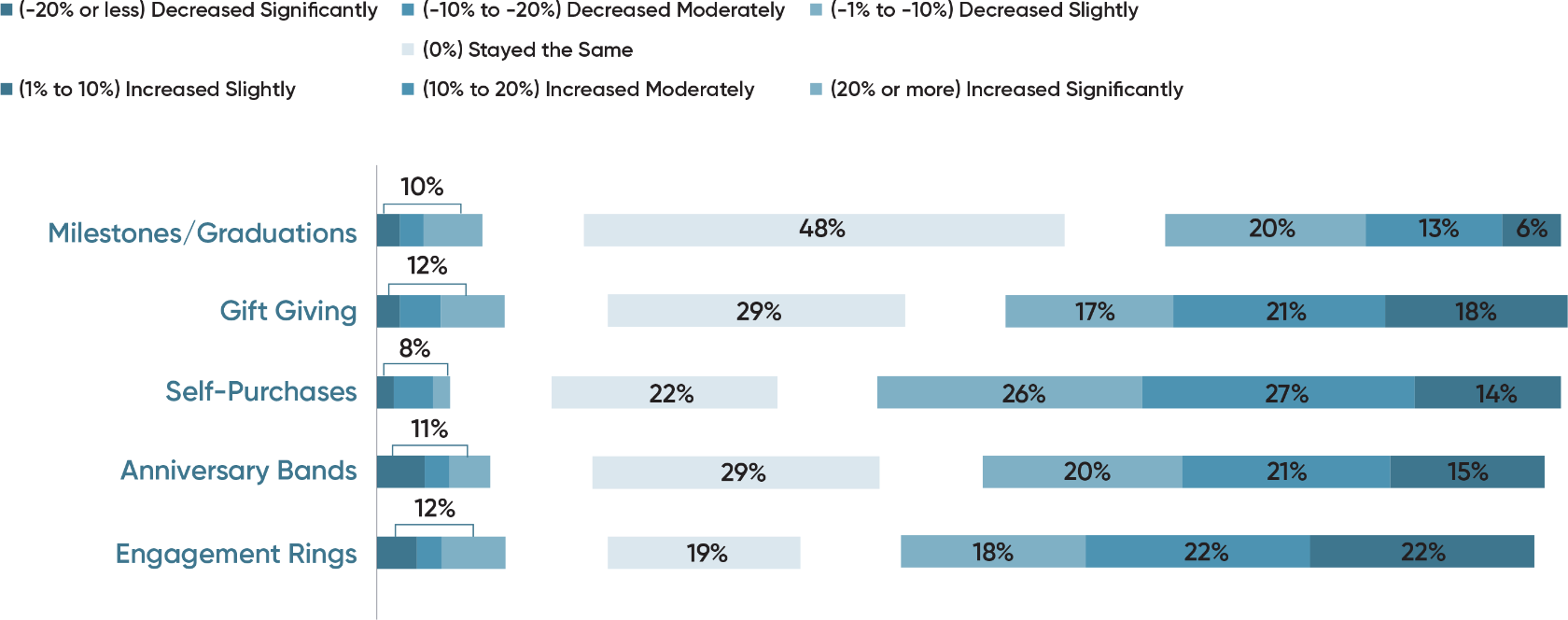

With many weddings and engagements postponed because of the pandemic it’s not surprising that retail jewelers saw a moderate to significant increase in sales (44%) for engagement ring sales over the past year. However, nearly as many (41%) saw moderate to significant increases in self purchasers, with gift-giving (39%) and anniversary bands (36%) close behind.

As compared to the pre-COVID-19 period, how have your costumers’ purchasing habits changed?

Key Takeaway:

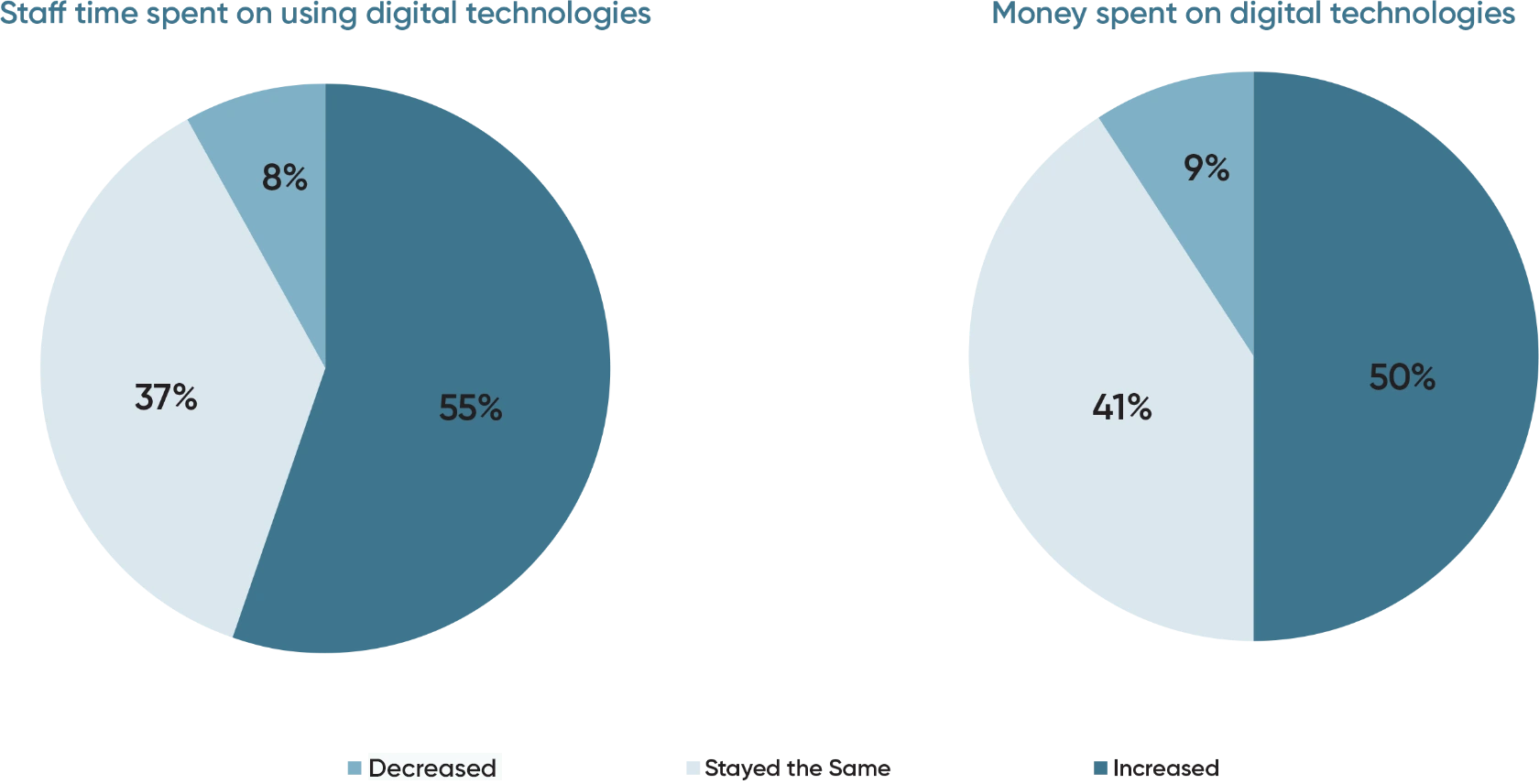

Digital technology is becoming essential to the retail jewelry business and is here to stay with more than 50% of respondents spending more in dollars and staff time in 2021 compared to 2020. Only a fraction (less than 10%) of jewelers reduced their spending on digital technology..

In 2021, how did your overall business spending on digital technology change when compared to 2020?

More than half of the businesses have invested more time (50%) and money (56%) in digital technology in 2021. Only about one-tenth of retail respondents have reduced the money and time spent on digital technology.

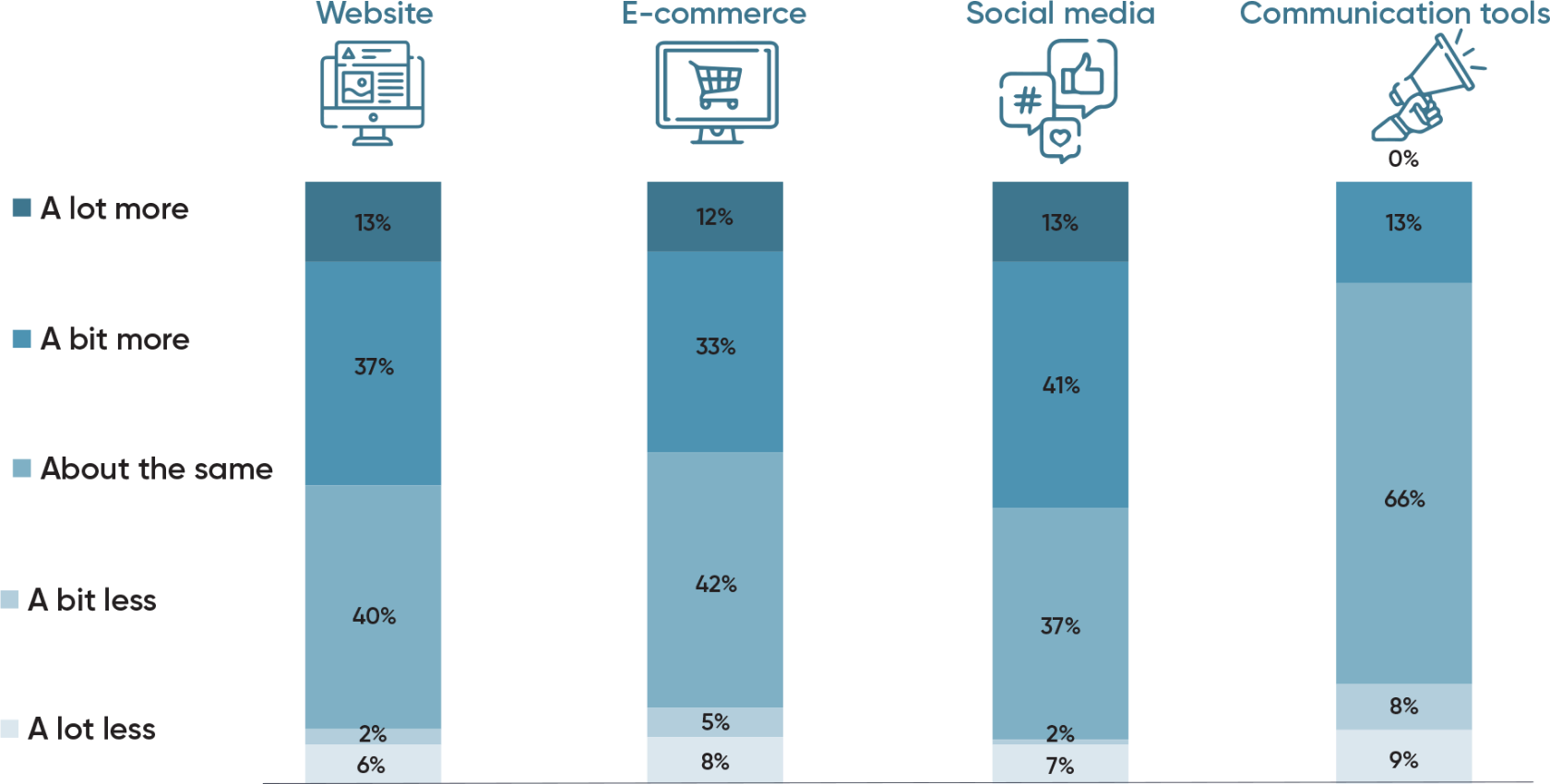

According to survey respondents, spending on digital technology is expected to continue increasing in 2022. About half of retail jewelers have plans to improve their digital capabilities this year by investing in their website, e-commerce, and social media presence.

Overall, do you plan on spending more or less money on the following digital technologies for business in 2022?

Social media, E-commerce, and Website spending appear to be gaining momentum in 2022. Communication tools are likely to see retailers maintaining their spending levels without major increases.

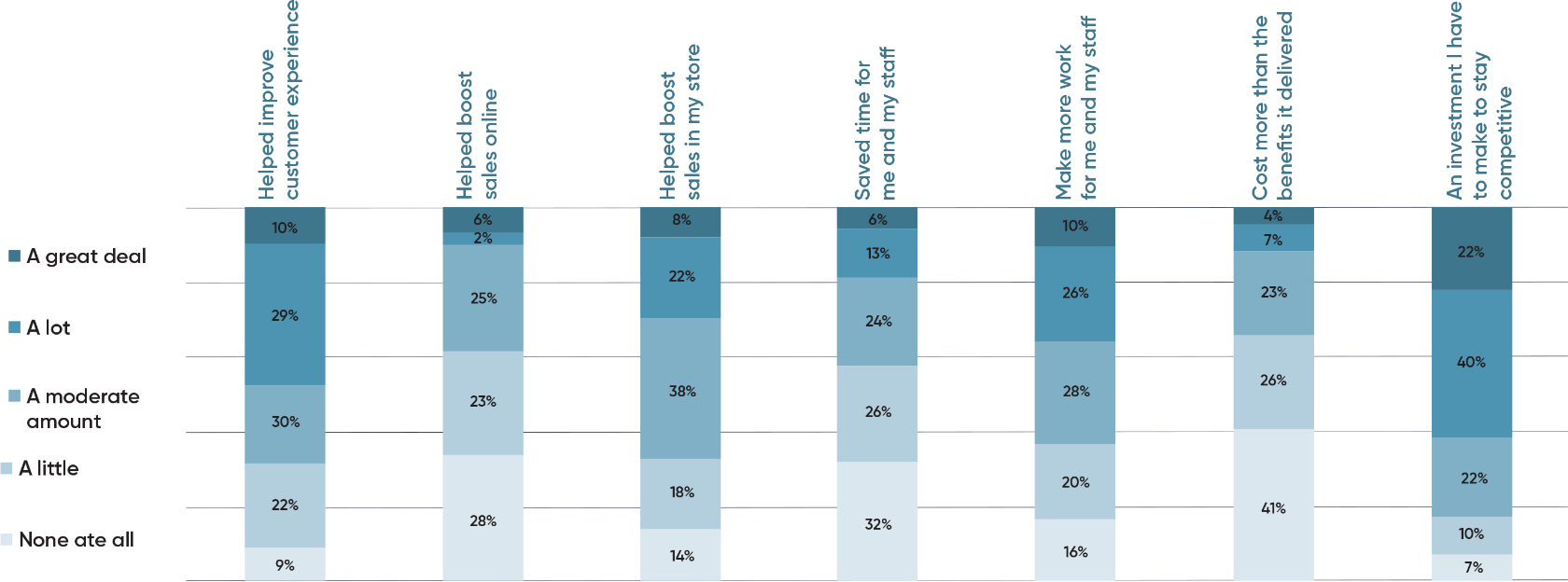

Nearly two-thirds (62%) of retail jeweler respondents said digital technology is an investment they have to make to stay competitive. Interestingly, 30% of retailers indicated that digital technology helped to boost sales in their stores by a great deal or a lot in the past year, while only 8% said technology helped boost their online sales a great deal or a lot.

How much of an impact has digital technology had on your business with respect to the following factors?

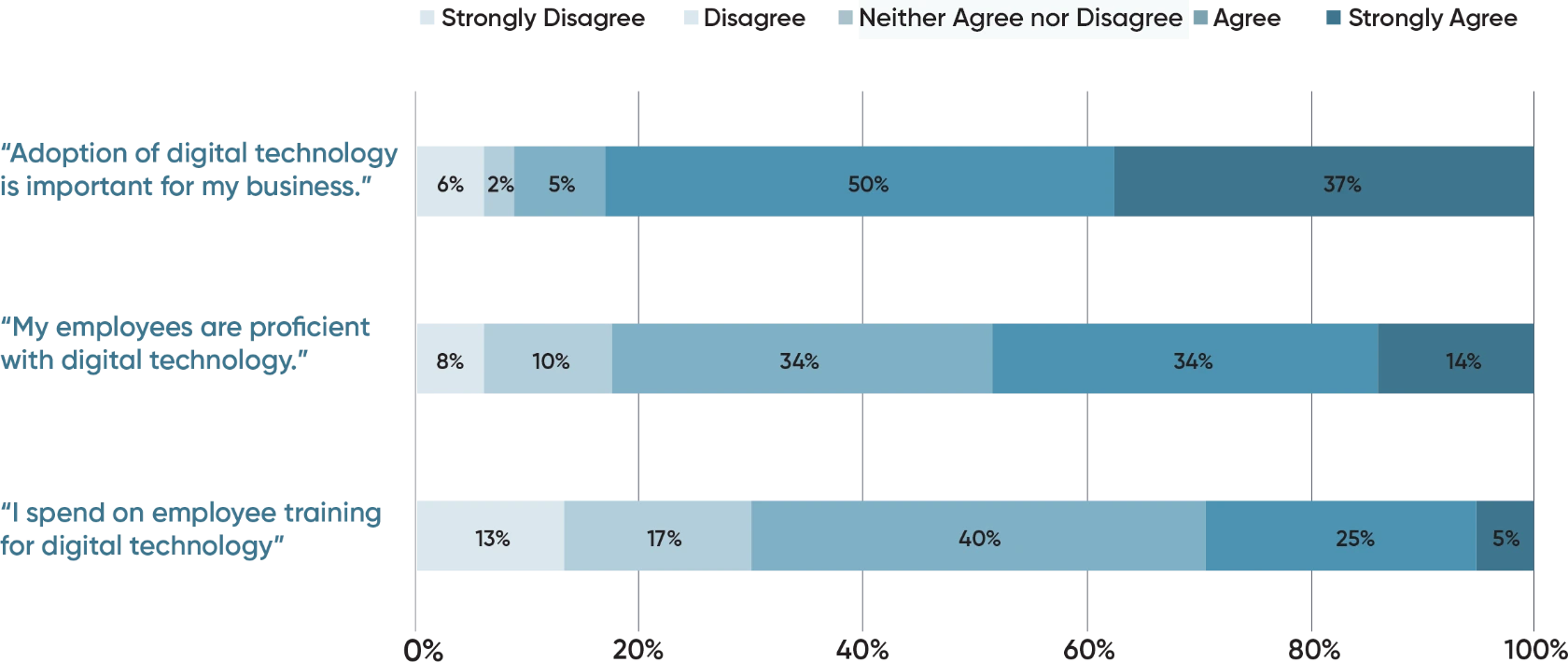

Recognizing the influence of digital technology, 87% of retail respondents agreed or strongly agreed that it is important for their retail jewelry business. Though it’s somewhat alarming that only about half (48%) are confident that their employees are proficient in digital technology while less than one-third (30%) spend on equipping their employees with training for the use of digital technology

How strongly do you agree or disagree with the following statements regarding Digital Technology for your business?

PART-2

How Has Digital Technology Spending Changed From 2020 To 2022

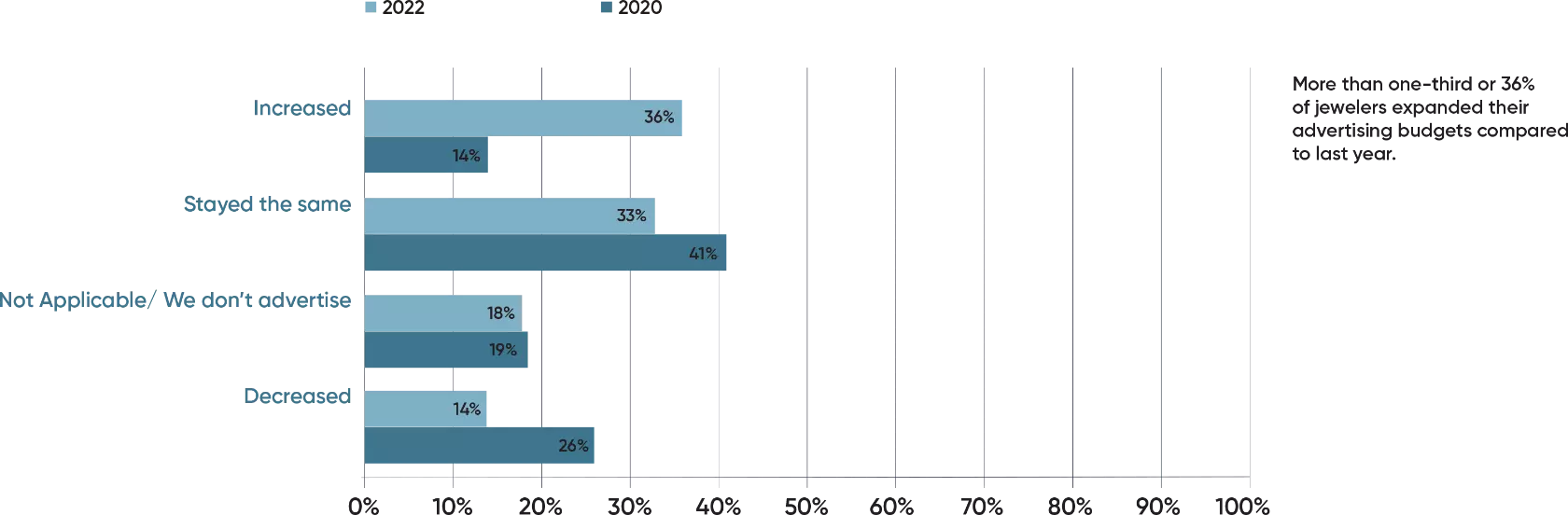

Retail jewelers have significantly increased their advertising budgets for 2021-2022 compared to the previous year. This likely reflects a reaction to the surge in demand and sales among consumers for luxury jewelry pieces and watches. It’s also a sign of how important jewelers see advertising as essential to the success of their stores.

How has your advertising budget changed in the last one year?

Key Takeaway:

Retail jewelers may want to adjust their digital marketing tactics to take advantage of email automation and targeting as well as explore other techniques and platforms for using social media such as TikTok and Instagram videos.

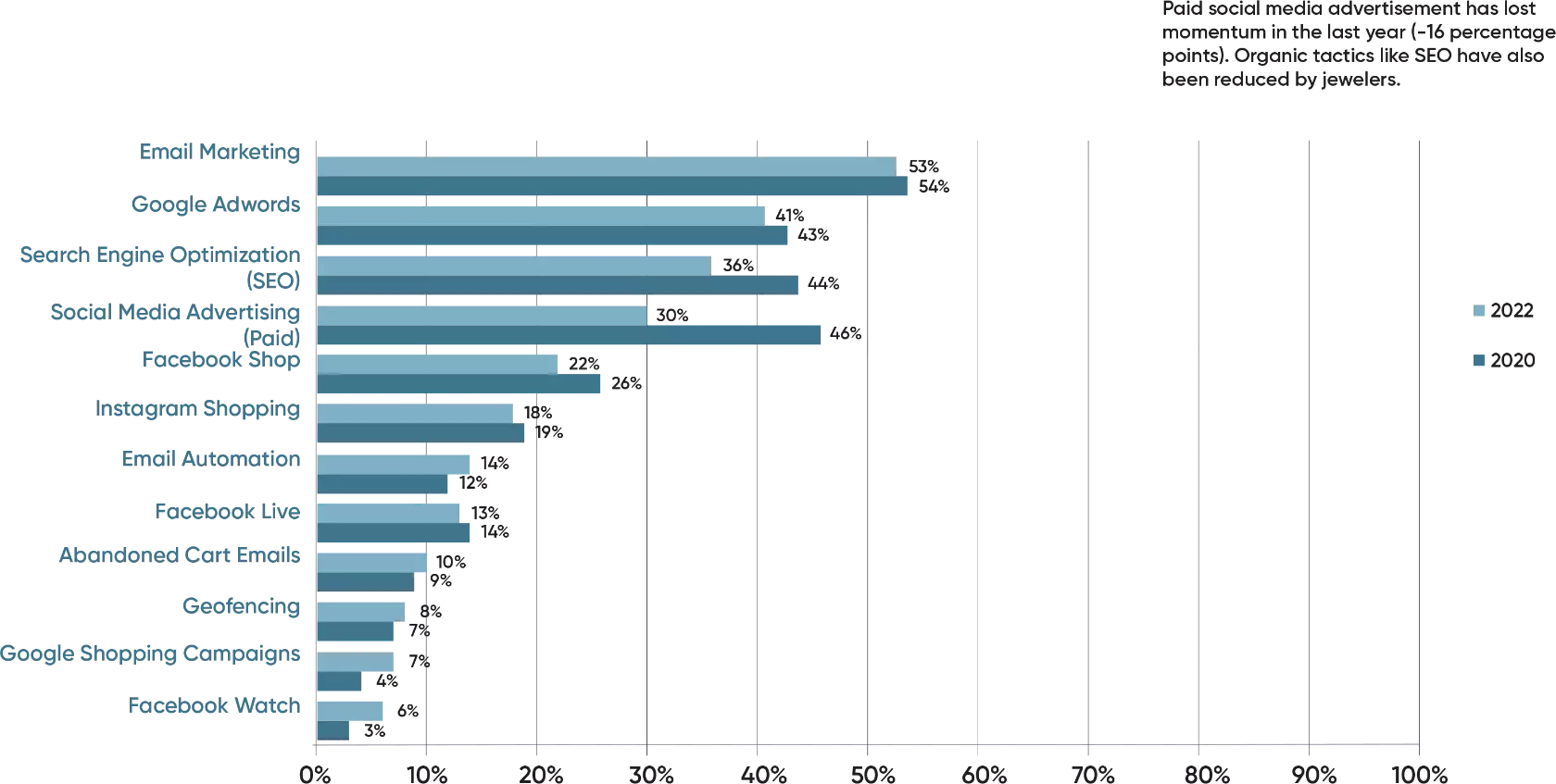

The biggest change in marketing tactics for our retail jeweler respondents was in paid advertising for social media and organic search engine optimization (SEO). The significant drop may be due the return of customers in store after lockdowns, and less reliance on social media to reach customers.

What digital marketing tactics do you use?

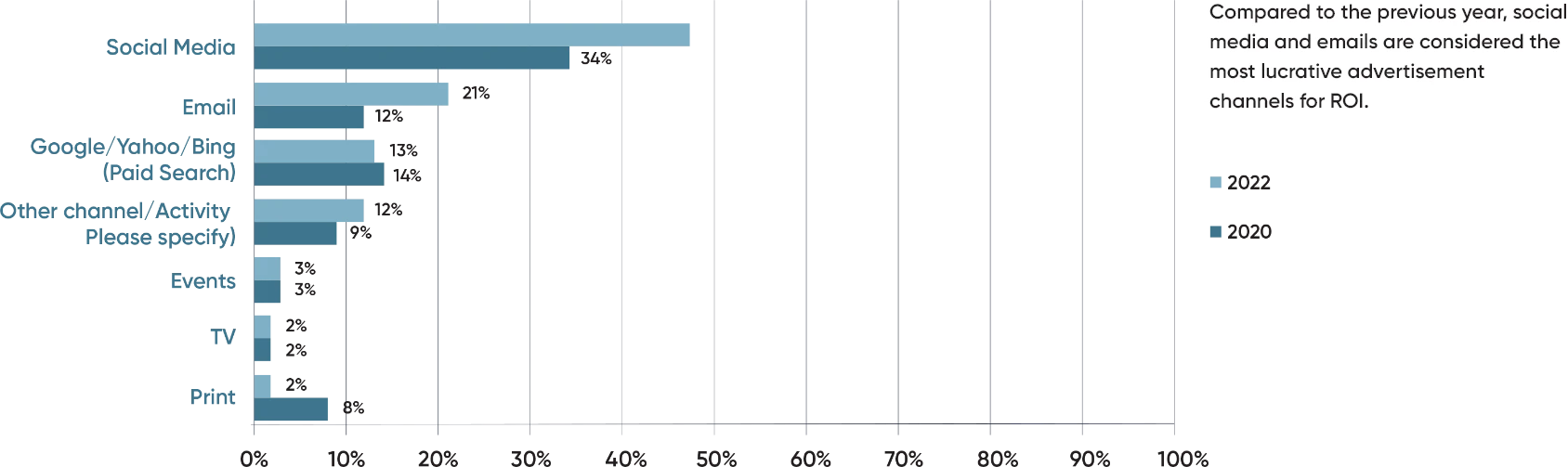

Even though the use of social media advertising dropped in the past year, retail jeweler respondents still believe that social media (paid and organic) provides the best return on their advertising investment, followed by email.

Print and TV advertising appeared to provide the least ROI, a reflection of the growing dominance of digital communications. The decrease in Paid Search could be due to general increases in the Cost Per Click of publishers that has affected nearly every industry.

Which advertising channel brings you the best return on investment (ROI)?

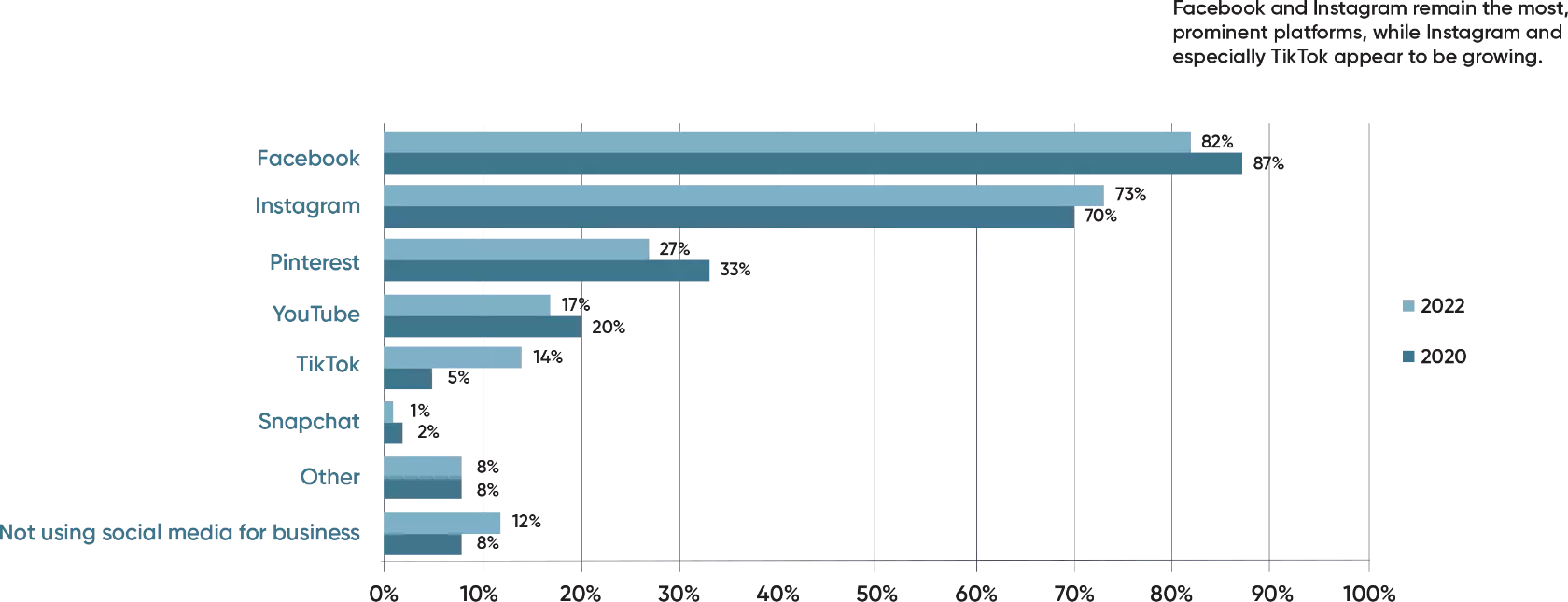

As a reflection of general social media popularity trends, especially among younger people, retail jewelers are relying heavily on Facebook and Instagram to promote their businesses, with minor changes versus 2020. One notable change shows the use of TikTok increasing significantly as a platform.

Which social media platforms(s) do you use for your business?

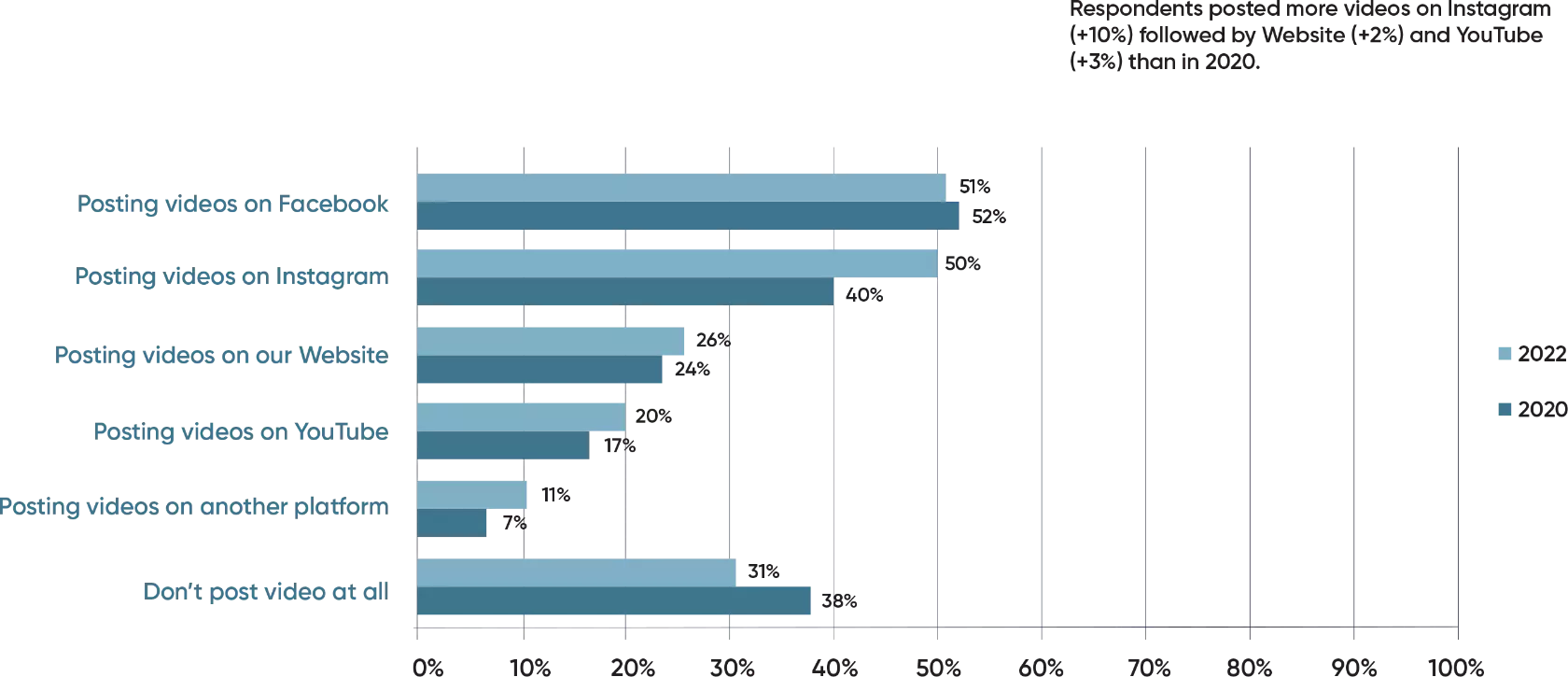

Jewelers are also leveraging videos to promote and market their business by posting them on various platforms. Facebook and Instagram remain the most preferred platforms over the past two years though Instagram use jumped by 10 percentage points.

How are you using video for marketing and promotion?

PART-3

Digital Technology Impact On Store Operations

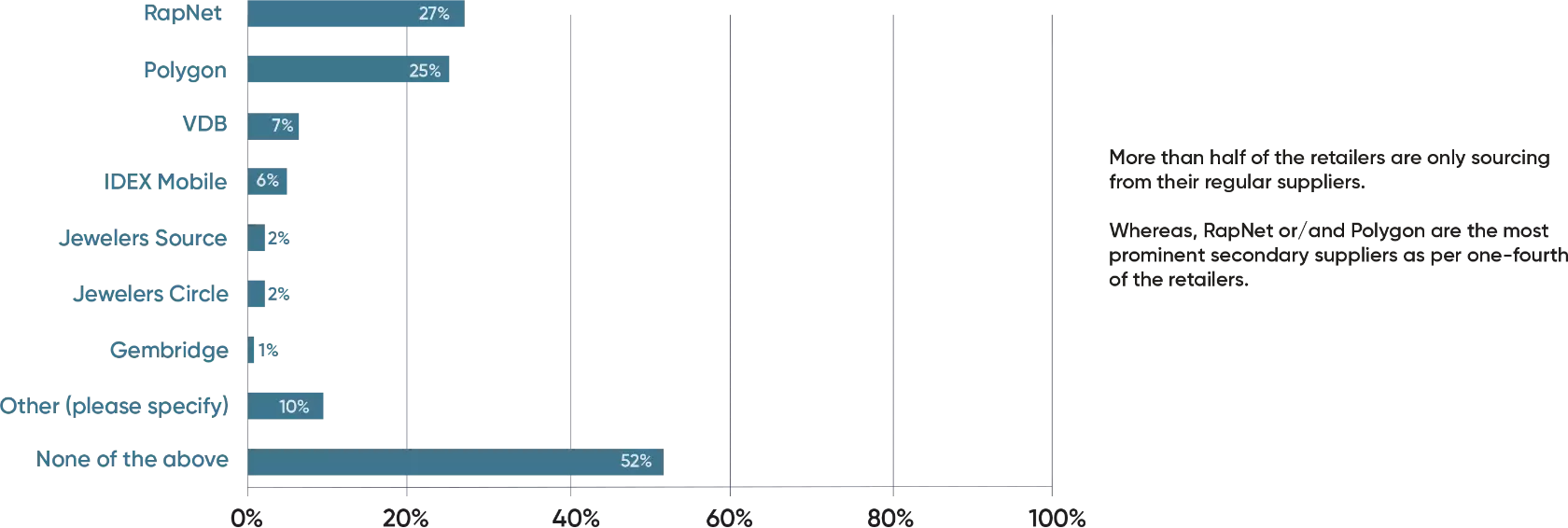

While digital technology is making a larger impact on retail store marketing to consumers, it’s also becoming a larger part of store operations. It appears, for example, that nearly half of retail jewelers are sourcing through RapNet (27%) and Polygon (25%) digital platforms, followed by the lab-grown diamond trading platform VDB used by 7% of the jewelers surveyed.

Beyond your regular suppliers, which of the following digital channels, buying groups, or B2B platforms are you sourcing from?

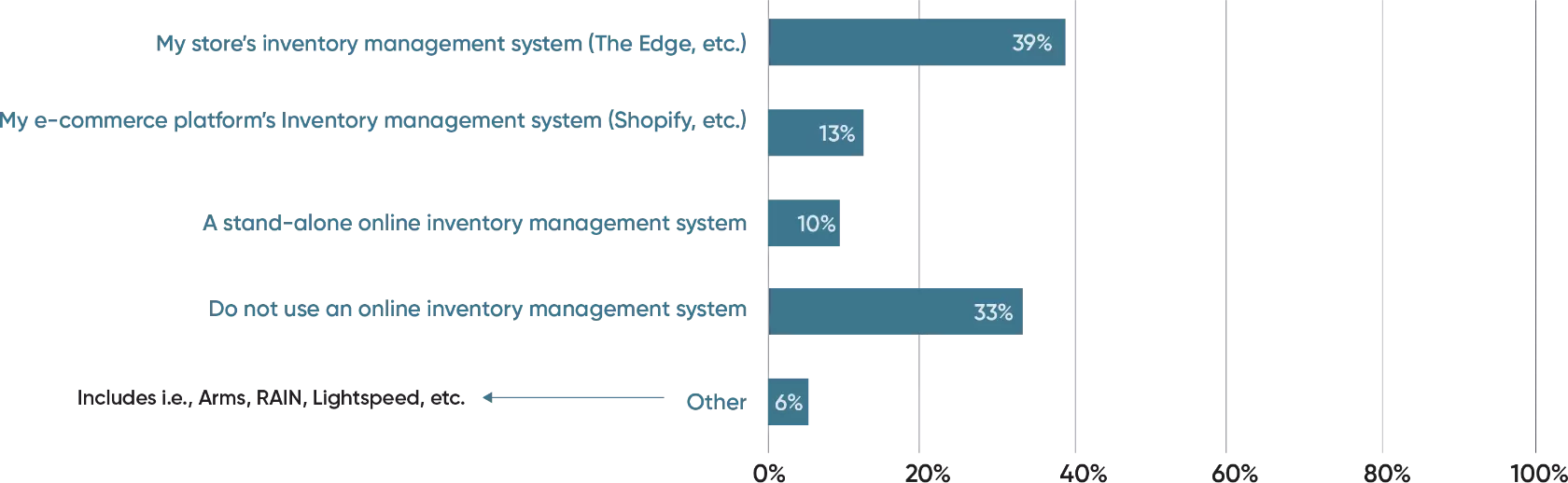

Most jewelers (39%) still rely on their store’s existing inventory management system for the online offerings. However, 13% and 10% of businesses respectively are using an ecommerce platform’s inventory management system or a separate stand-alone system.

What solution are you using to manage your online inventory?

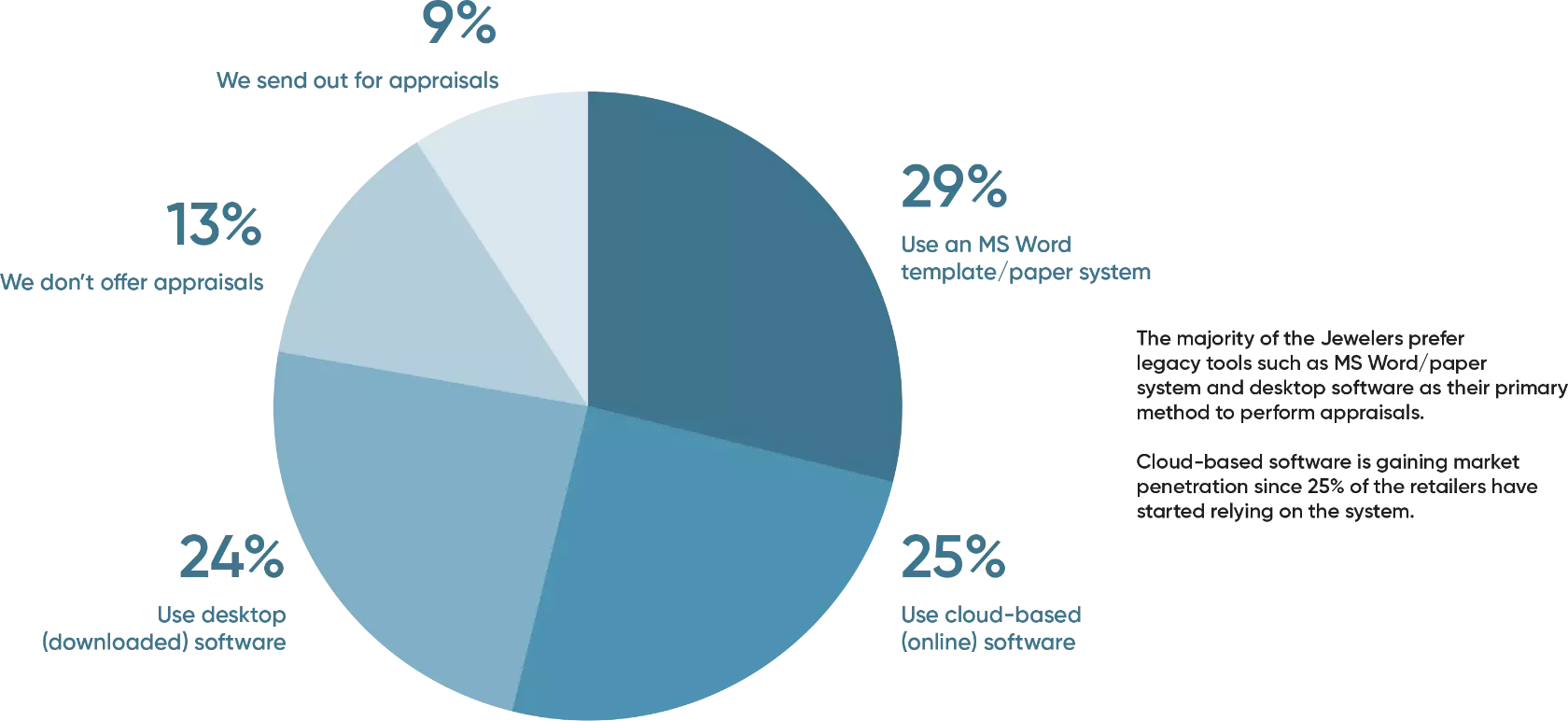

A substantial number of retail jeweler respondents (29%) are still using an MS Word or paper system to conduct appraisals. About one quarter (24% of respondents) are using downloaded software for appraisals while the other quarter is using cloud-based software to perform appraisals. Nearly a quarter of retail jeweler respondents (22%) either don’t offer appraisals or simply outsource them.

What primary method do you use to perform appraisals?

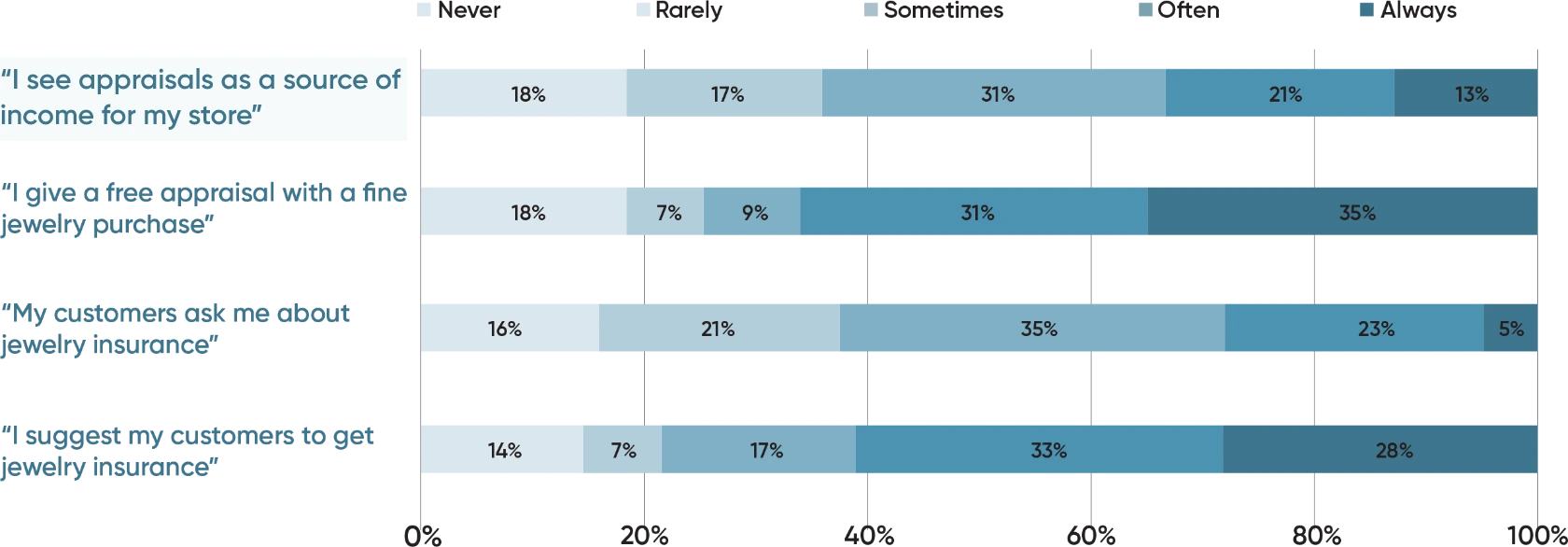

Jewelry appraisals are considered an important source of retail store income for 34% of the jewelers who responded to the survey. Two-thirds of jeweler respondents (66%) are providing a free appraisal to customers making a fine jewelry purchase.

Over 60% of the retail jeweler respondents (always or often) influence their customers to get jewelry insurance coverage. At the same time, customers also tend to ask jewelers about insurance to protect their purchases.

In terms of Appraisals and Jewelry insurance, how often do you do each of the following?

PART-4

The Characteristics Of Stores With Higher Sales

According to our survey results there is a direct correlation between leveraging digital technology and the experience of strong and surging sales at the respondents’ retail stores.

Actions among those surveyed that correlated to the surge in retail jeweler’s sales (at 95%-99% confidence interval) included:

- Increased spending for and adoption of digital marketing and operations technologies.

- Increased staff time and money spent on using digital technologies.

- Increased spending on training and improved digital technology skills of store employees.

- Increased the store’s advertising budget.

- Increased spending on the store’s website, social media, and e-commerce.

Related to the increase in demand experienced by stores in the past year or more, these actions among stores seeing the highest surge in sales included:

- Hiring more store employees

- Having store employees work extended hours

Interestingly, survey results showed a high correlation between surging sales and offering a free appraisal with a fine jewelry purchase at the store, and surging sales for stores which view appraisals as a contributor to store income.

RECOMMENDATIONS

Recognize the importance of and budget for integrating digital technologies into your store advertising and operations. Those retail stores that refuse to embrace digital technologies will likely be less competitive and fall further behind—especially if the consumers slow purchasing in the wake of rising inflation.

Digital technologies are evolving every day. You’ll likely need outside help in setting up or improving your website and social media posts (paid and otherwise).

Be sure to check for a vendor’s jewelry industry experience. Offering ecommerce transactions on your website is rapidly becoming a necessity to compete effectively in a digital world, especially in reaching and engaging younger customers.

There are several platforms (with Spotify appearing to be one of the most popular) that make adding e-commerce capability easier and affordable. Some agencies specialize in helping retail jewelers plan and implement an e-commerce strategy for their stores.

Look at ways in which you can improve the digital technology skills of your employees, including free resources to help educate your employees. Most of the major social media and customer communication platforms (For example: Facebook or Podium) have free online tutorials and educational videos to help them learn more.

RESOURCES

BriteCo Jewelry & Watch Insurance

Established in 2018 by a third-generation retail jeweler, BriteCo is a leading insurance technology provider focused on transforming the jewelry insurance industry for the digital age. BriteCo has democratized the process of buying 5-star rated jewelry and watch insurance for consumers with an easy-to-use online application, superior coverage in minutes, and an affordable subscription-like monthly payment option. Free Cloud-based Appraisal System for retail jewelers from BriteCo https://brite.co/for-jewelers/

International Gem Society (IGS)

IGS was initially founded to make gemology information accessible and affordable to everyone. Members can enroll in our gemology course and take the complete course through to certification. Now, the mission has evolved to bringing together people who want to learn, discuss and trade gemstones. Marketing Resources at https://www.gemsociety.org/

GemFind Digital Solutions

GemFind has been providing digital technology solutions to the jewelry industry since 1999 helping hundreds of jewelers with their online presence and digital marketing. GemFind connects retailers to their vendors through their proprietary state of the art technology JewelCloud, allowing retailers to showcase their vendors’ product data and digital assets on their websites in real-time. From consultation, design, development, launch to complete online marketing strategy and web apps like ring builder, diamond link, stud and pendant builder, GemFind is a one-stop shop for many retailers. Marketing Resources at https://gemfind.com/

Polygon: powered by mdf commerce

Since 1984, Polygon has helped jewelry professionals reach their target market in a secure, vetted network, with no commissions or transaction fees. Members benefit from unlimited access to 5 product databases, from diamonds, lab grown, jewelry, colored stones and watches. Plus, an active marketplace, diamond auctions, a trade directory, price reports, social groups, forums and more. The most complete marketplace for gem & jewelry pros. Try our PRO access FREE for 7 days!

https://www.polygon.net/jwl/public/services/free-trial-en.jsp

Instore Magazine

Instore magazine is a leading retail jeweler online and monthly print publication featuring retail trends and store examples. Once a year, jewelers get to review the state of the jewelry industry with highlights from Instore Magazine’s annual Big Survey. The Big Survey gives a rundown of the past year that includes best performing jewelry brands, lots of statistics and interesting anecdotes from the sales floor. It’s

once-a-year read not to be missed. Retail; Jeweler Big Survey at

https://instoremag.com/instore/instore-projects/big-survey/

Women’s Jewelry Association

For more than 30 years, the Women’s Jewelry Association has been a source of support, education, and camaraderie for women working in jewelry-related industries. It also welcomes men who want network and volunteer with influential industry friends. Across the U.S. and overseas, industry members flock to its meetings, use its networks, and gain valuable education and funds to advance in their careers.

Member Benefits at https://www.womensjewelryassociation.com/join