Notices & Disclosures

Please read the following notices and disclosures, as they pertain to your application for insurance.

Last Updated: 01/26/2021

Licensure

BriteCo Inc. is a licensed insurance agency in all fifty states and the District of Columbia. California License Number: 0M48637. Arkansas License Number: 3000426892. All insurance policies underwritten and issued by HDI Global Insurance Company and administered by BriteCo.

E-Submission of Application; E-Signature Agreement

IMPORTANT: You are submitting an application for insurance with HDI Global Insurance Company (“HDI”). In order for you to do so, described below is an overview of the insurance as well as certain legal rights and responsibilities relating to the coverage, the application, and your submission of the application. Please read everything in this page carefully and contact BriteCo at [email protected] or if you have any questions.

Consent to Electronic (“e”) Submission

- If you do not consent to e-submission, you may not submit your application using an e-signature.

- The application process does not involve any fee charged by us to use our website, but you of course may incur charges from your Internet service provider (ISP). Also, your ISP may experience system failures, and hyperlinks to documents may not function properly.

- You may withdraw your consent to completing or submitting this insurance application online by closing the active browser window or tab.

Duration of e-consent: Your consent and e-signature agreement applies only to your application for insurance with HDI through BriteCo.

Overview of Rates, Rules and Premiums for Coverage

- Annual Premium Rates

The total annual premium is based on the insurance replacement value for each item of jewelry insured. The rate is based on the residence location of the person possessing the jewelry, among other factors.

- Eligibility

- Only people living in the United States are eligible for personal jewelry insurance from HDI through BriteCo.

- Insurance is not available for loose stones not being set, damaged jewelry and watches, and non-jewelry items.

- Questions and Comments

Your jeweler is not an insurance agent of HDI or BriteCo and does not sell or recommend insurance. Please direct all questions and comments about insurance to BriteCo.

Electronic (“e”) Signature Overview

To apply for insurance with HDI through BriteCo using an e-signature, you must consent by clicking the [“NEXT (FINAL QUOTE)”] button. By clicking this button, you acknowledge reading and understanding the following “E-SIGNATURE AGREEMENT” terms and conditions. If you do not click [“NEXT (FINAL QUOTE)”], you cannot apply for insurance online, though you may request from us paper copies of all documents and apply by fax or mail.

E-Signature Agreement

I understand that clicking the [“NEXT (FINAL QUOTE)”] button means the following:

- I have read, and I understand, the “Overview of Rates, Rules and Premiums for Coverage” presented above in this page.

- I have full authority and legal capacity, whether individually or as a representative of a legal entity (like a trust, for example), both to apply for insurance with HDI and to consent (and I hereby consent) to any necessary background or credit check or investigation related to the application for insurance.

- I wish and intend to complete and submit to HDI an application for insurance with HDI.

- Through the “Submit Application” button, I am providing my e-signature, which is the legal equivalent of submitting a document signed by hand.

- I understand that my submission of the insurance application or payment of initial premium does NOT guarantee that HDI will issue a policy to me, and I may be contacted for further information before any decision is made on my application.

- I may call 312-809-9100 to obtain a paper copy of my completed application, at no charge. Note that a pdf copy of your completed application is supplied with your initial policy documents.

- I UNDERSTAND THE IMPORTANCE OF TRUE AND ACCURATE INFORMATION AND HAVE READ, AND I UNDERSTAND, THE FRAUD NOTICE.

Paperless Delivery Disclosure & Agreement

Please read this Paperless Delivery Disclosure and Agreement (“Disclosure”) thoroughly as it contains important information about your legal rights.

The words “I,” “you,” and “your” mean the policyholder(s) who desires to transact business electronically.

The words “we,” “us,” and “our” mean BriteCo, LLC (“BriteCo”). BriteCo reserves the right to update this Disclosure from time to time, and the latest version is always the version that governs the terms of your paperless delivery.

To conduct business with BriteCo electronically, you must read and consent to the following terms and conditions. By clicking the [“NEXT (FINAL QUOTE)”] button you are agreeing to the terms and conditions set forth in this Disclosure and confirming that you have the hardware and software capability (see item 4 below) to receive documents electronically. By agreeing to this Disclosure, you are acknowledging that you have the authority to receive Documents electronically on behalf of all insureds under your policy. Further, you understand and agree that we may provide to you in electronic format only all policy related documents, including those related to billing or claims matters, notices, endorsements, changes to your policy(ies) and any other information relating to your insurance policy(ies) (collectively, “Documents”) that would otherwise be mailed to you.

- Method for Paperless Delivery of Documents

All Documents will be delivered to you at the email address provided as part of the insurance application process.You may also request that we send you a paper copy of any Document, free of charge, by contacting us at:BriteCo LLC

909 Davis Street

Suite 500, Room 48

Evanston, IL 60201

Phone Number: 312-809-9100

Email Us: [email protected]

- Update Contact Information

It is your responsibility both to provide us with a complete email address, contact, and other information related to this Disclosure and your policy and to maintain and update promptly any changes in this information. You can update your contact information by contacting BriteCo.

- Hardware and Software Requirements

To access, view, and retain Documents, you must:Have a device that connects to the InternetHave access to an email accountHave access to an internet browserAll Documents within our website are provided in PDF format. Adobe Reader 9.0 or later versions is required. A free copy of Adobe Reader may be obtained from the Adobe website at: www.adobe.com.

- Withdraw Your Consent to Paperless Delivery

You may withdraw your consent to paperless delivery by contacting BriteCo.This means we will stop delivering your Documents to you electronically and send them to you via US Mail.You may also contact us by calling 312-809-9100 or emailing [email protected]

- Questions

If you have any questions about Paperless Delivery, you should contact us by calling 312-809-9100 or emailing us at [email protected]

- Retain a Copy for Your Records

We recommend that you retain a copy of this Disclosure and Agreement.

Insurance Replacement Value Update Agreement

By clicking the [“NEXT (FINAL QUOTE)”] button, you understand and agree to the following:

- BriteCo LLC (“BriteCo”) will periodically, at it’s own discretion, update the insurance replacement values of scheduled jewelry pieces (from your jewelry appraisal). These updates will typically correspond to the annual renewal of an insurance policy.

- Updated insurance replacement values are based on prior appraisal values and recent jewelry/watch market data.

- Updated insurance replacement values are subject to a minimum annual change of 0%.

- BriteCo will use the most recent insurance replacement value when calculating insurance premiums. However, per statutory laws in the state of New York, we will offer coverage at the same limits as the expiring policy for the required policy period.

- Periodic updates of insurance replacement values may not be available for certain pieces. This includes, but is not limited to:

a. Watches that are no longer in production or for which market data is sparse.

b. Jewelry for which market pricing data for components is sparse or non-existent.

Fraud Warning

GENERAL: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act.

The fraud warnings listed below are applicable in the following states: AL, AK, AZ, AR, CA, CO, DE, DC, FL, HI, ID, IN, KY, LA, ME, MD, MA, MN, NE, NH, NJ, NM, NY, OH, OK, OR, PA, TN, TX, VT, VA, WA or WV. If you are located in one of these states, please take time to review the appropriate warning prior to submitting your claim.

ALABAMA: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution, fines, or confinement in prison, or any combination thereof.

ALASKA: Any person who knowingly and with intent to injure, defraud, or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

ARIZONA: For your protection Arizona law requires the following statement to appear on this form: Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

ARKANSAS: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

CALIFORNIA: For your protection, California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

COLORADO: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

DELAWARE: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony.

DISTRICT OF COLUMBIA: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

FLORIDA: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

HAWAII: For your protection, Hawaii law requires you to be informed that presenting a fraudulent claim for payment of a loss or benefit is a crime punishable by fines or imprisonment, or both.

IDAHO: Any person who knowingly, and with intent to defraud or deceive any insurance company, files a statement of claim containing any false, incomplete, or misleading information is guilty of a felony.

INDIANA: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete, or misleading information commits a felony.

KENTUCKY: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime.

LOUISIANA: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

MAINE: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

MARYLAND: Any person who knowingly and willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly and willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

MASSACHUSETTS: Any person who knowingly and with intent to defraud any insurance company or another person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading information concerning any fact material thereto, may be committing a fraudulent insurance act, which may be a crime and may subject the person to criminal and civil penalties.

MINNESOTA: A person who files a claim with intent to defraud, or helps commit a fraud against an insurer, is guilty of a crime.

NEBRASKA: Any person who knowingly and with intent to defraud any insurance company or another person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading information concerning any fact material thereto, may be committing a fraudulent insurance act, which may be a crime and may subject the person to criminal and civil penalties.

NEW HAMPSHIRE: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

NEW JERSEY: Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

NEW MEXICO: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.

NEW YORK: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

OHIO: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

OKLAHOMA: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

OREGON: Any person who knowingly and with intent to defraud or solicit another to defraud an insurer: (1) by submitting an application, or (2) by filing a claim containing a false statement as to any material fact thereto, may be committing a fraudulent insurance act, which may be a crime and may subject the person to criminal and civil penalties.

PENNSYLVANIA: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent act, which is a crime and subjects such person to criminal and civil penalties.

TENNESSEE: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

TEXAS: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

VERMONT: Any person who knowingly and with intent to defraud any insurance company or another person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading information concerning any fact material thereto, may be committing a fraudulent insurance act, which may be a crime and may subject the person to criminal and civil penalties.

VIRGINIA: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

WASHINGTON: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines, or denial of insurance benefits.

WEST VIRGINIA: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Consumer Reports Notice

By obtaining a quote or purchasing insurance from BriteCo LLC you are authorizing BriteCo LLC to obtain and use information about you from third party sources. Any such information obtained or used by BriteCo LLC is subject to BriteCo’s Privacy Policy and Terms of Use. If you have questions or complaints regarding our use of consumer reports, Privacy Policy or practices, please contact us at [email protected]. Below are the specific terms to which you hereby agree:

RESIDENTS OF STATES OTHER THAN ALASKA, CONNECTICUT, IOWA, KANSAS, NEVADA, NEW YORK, or WEST VIRGINIA

To rate and/or underwrite this application for insurance, we may use a credit-based insurance score developed by a third party based on information contained in the applicant’s credit report. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. Future reports may be used to update or renew insurance.

By proceeding with the quote and/or purchase, I confirm compliance with disclosure requirements.

RESIDENTS OF ALASKA

In connection with this application for insurance, we may review the applicant’s credit report or obtain or use a credit-based insurance score based on the information contained in that credit report. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. We may use this information to decide whether to insure you or how much to charge. We may use a third party in connection with the development of your insurance score.

RESIDENTS OF CONNECTICUT

To rate and/or underwrite this application for insurance, we may review the applicant’s credit report or obtain or use an insurance score based on the information contained in that credit report. We may use a third party in connection with the development of the applicant’s insurance score. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. The company has established an internal appeal process allowing you to provide documentation to establish the existence and duration of personal circumstances justifying that certain adverse credit information not be used.

RESIDENTS OF IOWA

To rate and/or underwrite this application for insurance, we may review the applicant’s credit report or obtain or use an insurance score based on the information contained in that credit report. We may use a third party in connection with the development of the applicant’s insurance score. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. Future reports may be used to update or renew insurance. The company has established an internal appeal process allowing you to provide documentation to establish the existence and duration of personal circumstances justifying that certain adverse credit information not be used. To request further information about our internal appeal process, including how to apply for an exception, you may contact us at [email protected] .

RESIDENTS OF KANSAS

To rate and/or underwrite this application for insurance we will review the applicant’s credit report or obtain or use a credit-based insurance score based on the information contained in that credit report. We may use a third party in connection with the development of your insurance score. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. Future reports may be used to update or renew your insurance. The company has established an internal appeal process allowing you to provide documentation to establish the existence and duration of personal circumstances justifying that certain adverse credit information not be used.

RESIDENTS OF NEVADA

To rate and/or underwrite this application for insurance, we may review the applicant’s credit report or obtain or use an insurance score based on the information contained in that credit report. We may use a third party in connection with the development of the applicant’s insurance score. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. Future reports may be used to update or renew insurance. The company has established an internal appeal process allowing you to provide documentation to establish the existence and duration of personal circumstances justifying that certain adverse credit information not be used. To request further information about our internal appeal process, including how to apply for an exception, you may contact us at [email protected].

RESIDENTS OF NEW YORK

In connection with this application for insurance, we may review the applicant’s credit report or obtain or use a credit-based insurance score based on information contained in that report. An insurance score uses information from the credit report to help predict how often you are likely to file claims and how expensive those claims will be. Typical items from a credit report that could affect a score include, but are not limited to, the following: payment history, number of revolving accounts, number of new accounts, the presence of collection accounts, bankruptcies and foreclosures. The information used to develop the insurance score comes from the following consumer reporting agencies: Experian, TransUnion, or Equifax. We may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. Future reports may be used to update or renew your insurance.

RESIDENTS OF WEST VIRGINIA

Your credit information is used by BriteCo LLC and/or HDI Global Insurance Company to produce a credit score. This credit score has an effect on the premium that you pay for your insurance. HDI Global Insurance Company is required by the Insurance Commissioner to recheck your credit information no less than once every 36 months for changes. You have the option to request that BriteCo LLC and/or HDI Global Insurance Company recheck your credit score more frequently than once every 36 months, but you can only make this request once during any twelve-month period. If there has been a change in your credit score, BriteCo LLC and/or HDI Global Insurance Company shall re-underwrite and re-rate the policy based upon the current credit report or credit score. The change in your credit score may result in an increase or a decrease in the premium that you pay for your insurance. Any changes in your premium will take place upon renewal if your request is made at least 45 days before your renewal. If the request is made less than 45 days before your renewal date, the insurer shall re-underwrite and re-rate the policy for the following renewal.

In connection with this application for insurance, we may also use insurance claims history developed by a third party based on claims information provided by participating insurance carriers. Future reports may be used to update or renew your insurance.

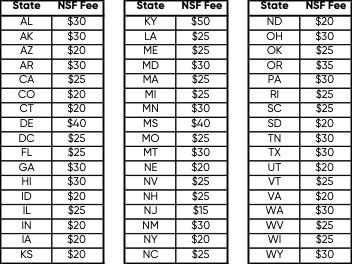

Non-Sufficient Funds Fee Disclosure

Returned checks may be subject to a non-sufficient funds fee (NSF Fee) in your state. The NSF Fees by state are: