2025 BRITECO RESEARCH REPORT

The Lab-Grown Vs. Natural Diamond Revolution:

New Data Reveals Consumer Insights, Trends, and Predictions

New Data Reveals Consumer Insights, Trends, and Predictions

Over the past five years, lab-grown diamonds have fundamentally reshaped the diamond jewelry industry, evolving from a niche product into a mainstream choice now accounting for more than 45% of all US engagement ring purchases. This dramatic growth has been fueled by improved manufacturing efficiencies, changing consumer preferences — especially among Millennials and Gen Z — and shifting market dynamics exacerbated by COVID-era inflation.

BriteCo’s proprietary data reveals significant changes in pricing, style, and consumer purchase behavior, including a marked increase in carat size, quality, and diversity of shapes in lab-grown diamonds for engagement rings. As prices for lab-grown stones continue to fall and natural diamonds work to reclaim their luxury status, the industry is bifurcating: Lab-grown diamonds are emerging as accessible, everyday luxury, while natural diamonds reposition as exclusive symbols of enduring value.

Looking ahead, BriteCo anticipates continued innovation, market segmentation, and a potential swing back toward natural diamonds in certain categories like engagement rings.

Market Shift

Lab-grown diamonds have significantly disrupted the diamond jewelry industry, evolving from a niche to a mainstream choice, accounting for over 45% of US engagement ring purchases by 2024.

Pricing

Consumer Preferences

Style Trends

Retailer Adaptations

Industry Bifurcation

The retail jewelry industry is bifurcating: lab-grown diamonds are becoming an accessible, everyday luxury, while natural diamonds are repositioning as exclusive symbols of enduring value.

Future Predictions

Contributing Factors

The past five years have been tumultuous for the jewelry industry. Retailers and wholesalers have had to navigate industry-specific and macroeconomic factors. Lab-grown diamonds, in particular, have become a serious disruptor. What was once a small, niche market compared to the multi-billion dollar sales of natural diamonds, lab-grown diamonds have gone mainstream, accounting for as much as 45% of diamond engagement ring purchases in the US in 2024.

The impact on diamond prices from the introduction of lab-grown stones has been just as dramatic. The rapid improvement in lab-grown diamond quality and a steep decline in prices have created significant competitive pressure on the sale of natural diamonds, resulting in declining average engagement ring prices — from about $6,000 in 2021 to $5,200 by 2024. The acceptance of lab-grown diamonds and their widespread availability hasn’t just impacted prices; however, it has also influenced styles.

To help understand the dramatic changes occurring in the diamond market, this report aims to help explain the impacts lab-grown diamonds are having on the jewelry industry and consumers. BriteCo has tapped into hundreds of thousands of proprietary appraisal and insurance data points over the past five years to identify several trends and make educated predictions.

For practical purposes, the lab-grown diamond is a “real” diamond in that its properties are identical to that of an earth-mined diamond. However, as the name implies, lab-grown diamonds are created in a controlled-environment manufacturing process in a matter of weeks. That contrasts with the formation of earth-mined or “natural” diamonds that have taken shape in the earth over millions of years.

The technological breakthroughs in producing lab-grown diamonds, introduced around 2015, have radically reshaped the diamond industry. Although scientists had been attempting to synthesize diamonds since the 19th century, success remained elusive until high-pressure, high-temperature (HPHT), and chemical vapor deposition (CVD) techniques matured.

By 2015, lab-grown diamonds could be produced with a quality on par with natural stones. This innovation disrupted the traditional pricing model for natural diamonds which have seen a decline in price as lab-grown diamonds have flooded the market. By 2025 a natural 1-carat diamond in 2025 costs an average price around $4,200 (with a typical range from $3,000 to $6,000 or higher depending on quality), while a lab-grown 1-carat diamond average price is now $1,000 or less.

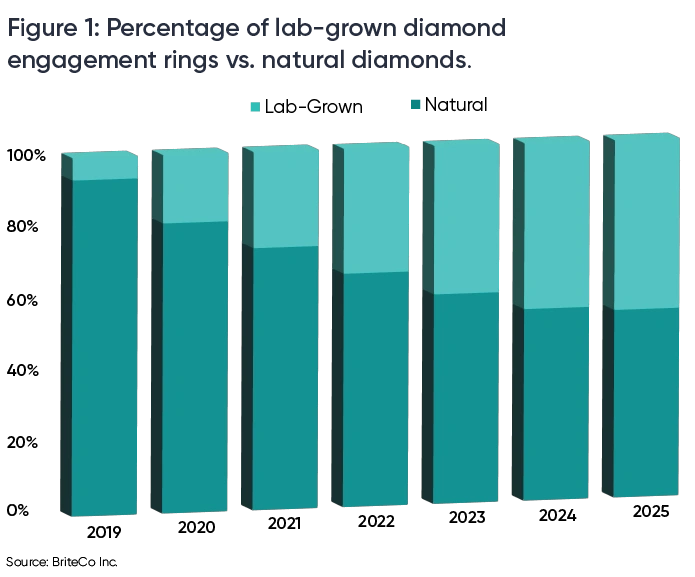

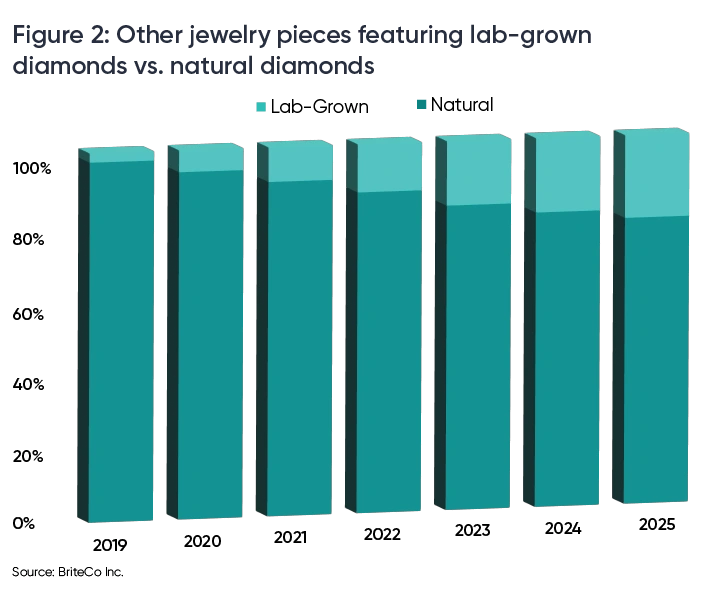

When BriteCo began collecting data in 2019, a mere 5.2% of all diamond jewelry sold was primarily lab-grown diamonds. Of diamond engagement rings, only 6.3% had a lab-grown center stone. For diamond jewelry outside of engagement rings, a mere 2.5% of all items sold were made from lab-grown diamonds.

Over the past five years, BriteCo has observed explosive growth in lab-grown diamond jewelry. Today, 42.1% of all diamond jewelry sold is comprised of lab-grown diamonds: 47.7% of all engagement rings, (Fig 1) and 22.4% of other jewelry types sold so far in 2025 were primarily lab-grown diamonds. (Fig 2)

Thus, the relative market share of lab-grown jewelry has grown 709.6% over the past five years. That phenomenal market shift can be attributed to a number of forces operating simultaneously in the US during this time.

The rise of lab-grown diamond popularity can’t be attributed to a single market force, but rather the coalescence of circumstances. While the proliferation of lab-grown diamonds may be considered by some to be inevitable given the improvements in technology, the cumulative impact of external forces accelerated this trend. BriteCo has identified major market drivers that we believe contributed most to the rise of lab-grown diamonds.

1. Increased Manufacturing Efficiencies and Growth in Supply — Retail prices for lab-grown diamonds have dropped sharply due to improved manufacturing efficiency and significant supply increases from producers in China and India. This has spurred market competition, making lab-grown diamonds far more affordable than natural diamonds.

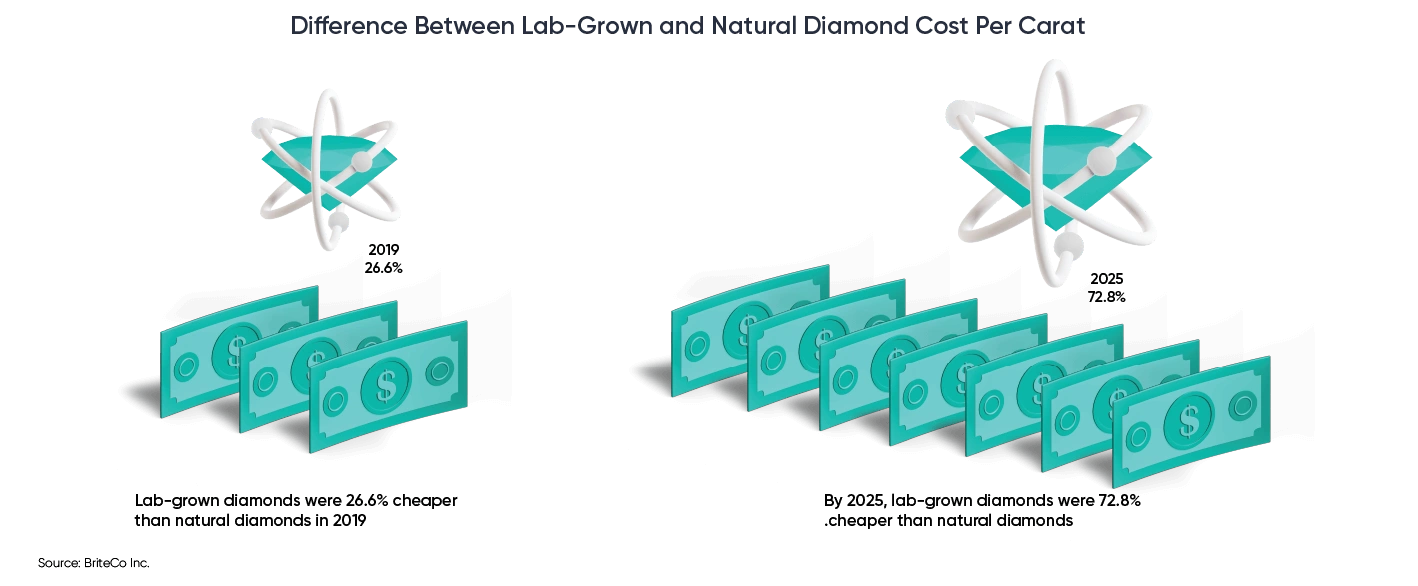

In 2019, using BriteCo data, for example, the cost of a lab-grown engagement ring on a per-carat basis was 26.6% lower than its natural diamond counterpart. Today, the difference is even more dramatic — 72.8%. Thus, the larger the diamond, the larger the discount for a lab-grown diamond versus a natural diamond.

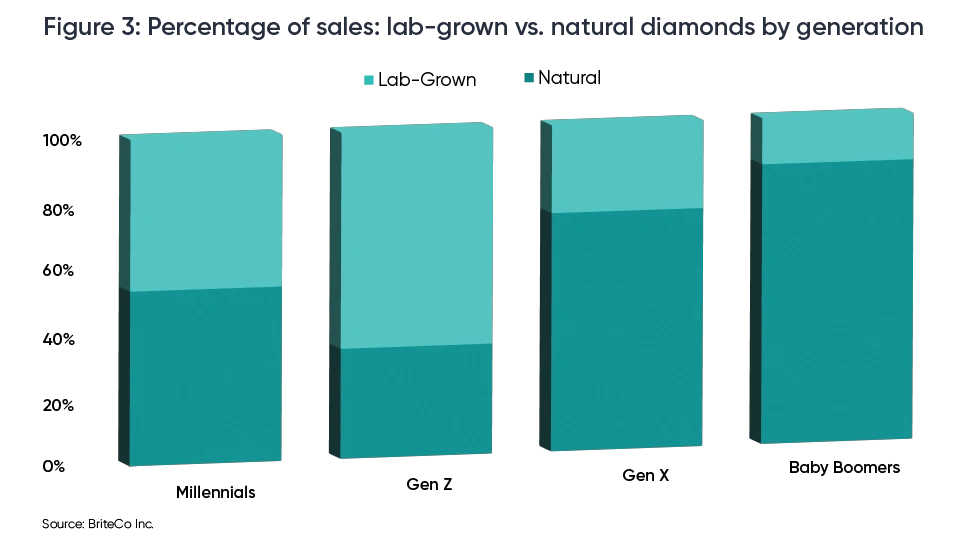

2. A New Generation of Consumers — A study of US consumers in 2022 indicated that younger generations were embracing lab-grown diamonds and were fast becoming a major force in their acceptance. According to BriteCo data, Millennials, and especially Gen Z, are at the forefront of lab-grown adoption.

For Millennials, there’s a near 50/50 split of engagement ring sales between natural and lab-grown. For Gen Z, it’s not even close. Two-thirds of Gen Z engagement ring purchasers opt for lab-grown diamonds. (Fig 3)

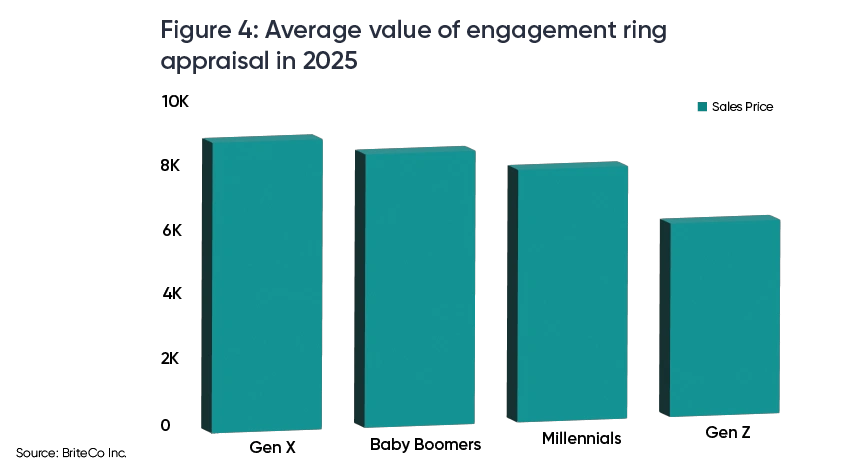

According to BriteCo data, as Gen Z and Millennials have chosen more lab-grown diamonds, especially for engagement rings, the price of engagement rings has trended down. (Fig 4)

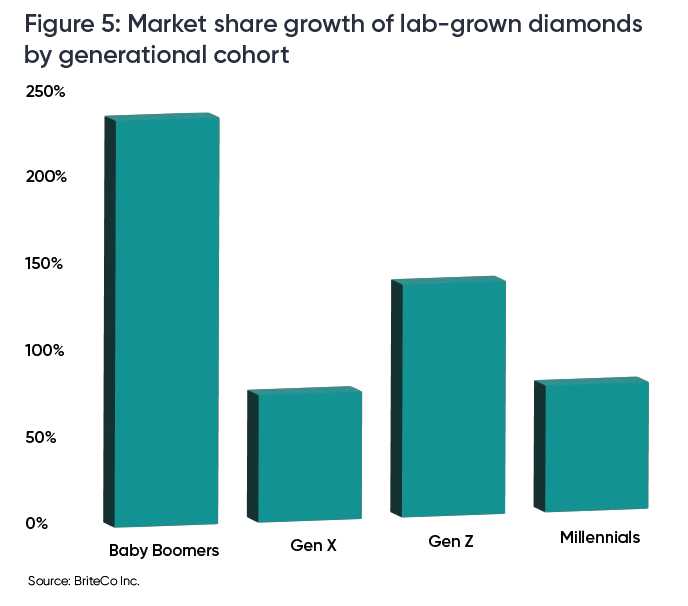

3. Shifting Sentiment Among Consumers and Retailers — While Gen Z and Millennials have led the way in the growth of lab-grown diamonds, there has also been a shift among consumers of all ages towards lab-grown. BriteCo data reveals that every group experienced double or triple-digit growth in the market share of lab-grown diamonds. (Fig 5)

Retail jewelers have responded to the demand for lab-grown diamonds by expanding their offerings, investing in consumer education, innovating with new designs, adjusting pricing strategies, and promoting the perceived ethical and environmental benefits of lab-grown stones.

These adaptations have allowed them to capture a rapidly growing segment of the market, though they also face new challenges in profitability and competition as the market matures.

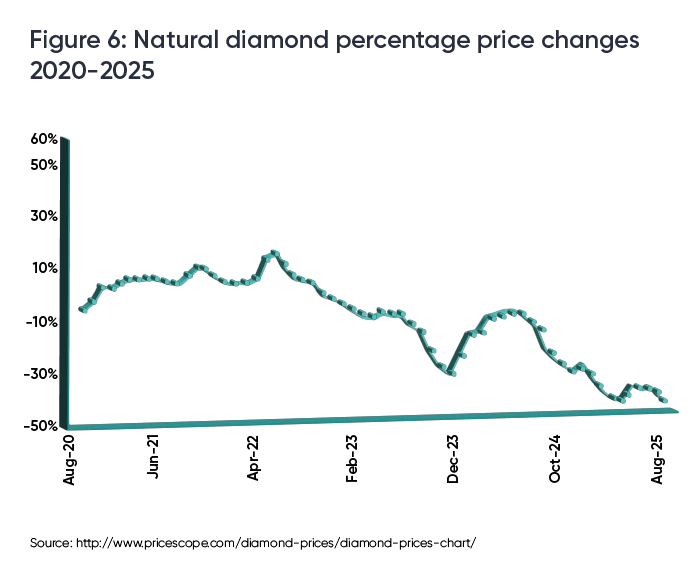

4. A COVID Inflation Spike — The wholesale price of 1-carat natural diamonds in the US from 2019 to 2025 shows a notable peak during the pandemic years, followed by a steady decline and some recent stabilization.(Fig 6)

Over the same period, lab-grown diamond prices have steadily declined as supply has flooded the market. (Fig 7)

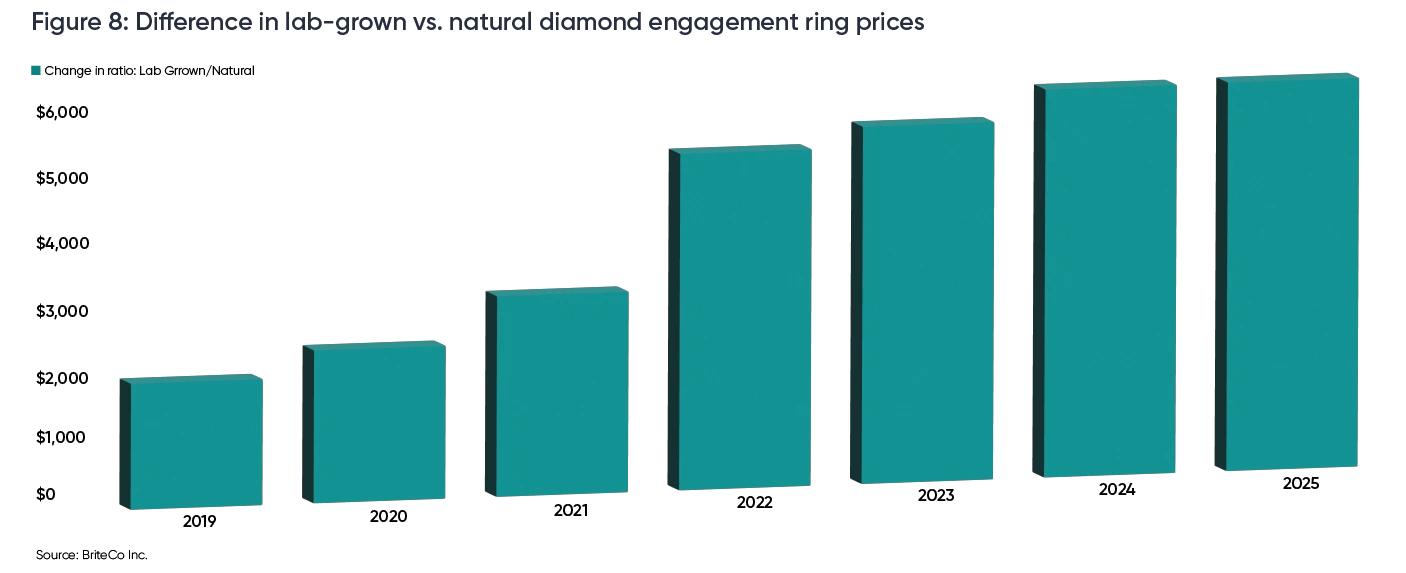

According to BriteCo data, the difference in price per carat between lab-grown and natural engagement ring diamonds has increased every year but saw the largest jump in 2022, when it grew 67.7%. (Fig 8)

The natural spike in 2021 was a major driver in lab-grown adoption. Once consumers saw the value in purchasing a lab-grown diamond, there was no going back.

According to BriteCo data, the difference in price per carat between lab-grown and natural engagement ring diamonds has increased every year but saw the largest jump in 2022, when it grew 67.7%. (Fig 8)

The natural spike in 2021 was a major driver in lab-grown adoption. Once consumers saw the value in purchasing a lab-grown diamond, there was no going back.

5. Gold Prices — Investors have rekindled interest in gold as an asset class. The price has risen from $1,725.65 an ounce in May 2020 to $3,289.55 in May 2025, a 90.6% increase in just five years. (Fig 9)

With the price of gold nearly doubling, the cost of the setting relative to the diamond saw a significant increase. For budget-constrained customers, this may indicate they are opting for a lab-grown diamond instead of a natural diamond to stay within a given budget.

The rapid changes brought about by the popularity of lab-grown diamonds go beyond their impact on price. BriteCo data indicates several noticeable style trends that are directly attributable to the broader availability and lower costs of lab-grown diamonds.

Consumers aren’t just pocketing the savings from lower natural and lab-grown diamond prices. They have been using part of those perceived sayings to buy bigger diamonds, especially lab-grown diamonds.

Based on BriteCo data, the average size of a lab-grown center diamond for an engagement ring increased from 1.31 to 2.45 carats from 2019 to 2025, an 87.0% increase! (Fig 10)

For reference, the average width of a 1.31-carat diamond is about 7.1 mm, while the average width of a 2.45-carat diamond is about 8.9mm. The surface area of the top of a lab-grown diamond increased 57.1% over that same time period.

Millennials in particular are changing the landscape of engagement rings and fine jewelry purchasing. Many value the ability to get a larger or higher-quality lab-grown diamond for the same price as a mined or natural diamond. In contrast, natural diamond engagement ring weight (carat) showed much less growth in size. (Fig 11)

Thanks to an improvement in production processes, many lab-grown diamonds today exhibit higher quality in terms of color and clarity. In 2020, for example, 37.7% of all lab-grown diamonds sold were colorless. By 2025, that increased to 85.9%. (Fig 12)

Likewise, in 2020, VVS1 and VVS2 lab-grown diamonds* represented 6.6% of lab-grown diamonds sold, which increased to 35.3% in 2025.(Fig 12) The same trend applies to natural diamonds. This reinforces the trend that consumers aren’t just taking advantage of lower prices to save money, but rather making purchases based on a specific budget and “buying up” on quality.

*VVS1 and VVS2 are clarity grades used to describe the quality of both natural and lab-grown diamonds, specifically referring to the presence and visibility of internal flaws known as inclusions.

According to BriteCo data, the increase in lab-grown diamond sales has shifted consumer preferences from round shapes to other shapes. In 2020, more than half or 53.8% of lab-grown diamonds and 55.2% of natural diamonds sold were round in shape.

By 2025, only 24.3% of lab-grown diamonds sold and 47.9% of natural diamonds sold were round in shape. In 2025, oval is the most popular shape for lab-grown diamonds.(Fig 13)

The change in diamond shape preferences may be due to natural diamond consumers traditionally choosing round shapes because they are perceived as more rare and valuable. Lab-grown diamonds, on the other hand, have little or no perceived after-market value, and therefore, a consumer would likely choose whatever shape best fits their personal tastes.

BriteCo data points to consumers taking advantage of low diamond prices by purchasing more non-bridal pieces of jewelry.

In 2020, bridal, consisting of engagement rings and wedding bands, represented 69.5% of all purchases. By 2025, that decreased to 60.2%. One item whose popularity has increased over time is tennis bracelets. In 2020, tennis bracelets were only 3.5% of sales. By 2025, that number grew to 11.9% – a substantial 240% increase in market share. Thus, lab-grown diamonds have helped make a tennis bracelet much more affordable and popular for consumers.

The cost of a jewelry piece has two distinct parts. One part is for the gemstones (including diamonds) in the piece, and one for the setting. Historically, retail jewelers made small margins on expensive diamonds and large margins on relatively inexpensive settings.

A simple analogy for the jewelry setting is the typical “loss leader” product that helps bring the customer into the store to purchase other higher-margin products. Since the price of diamonds has dropped, however, jewelers are selling higher overall purity settings. This suggests that jewelers are making up for lower prices and margins on diamonds with more expensive settings to help maintain their margins.

Looking at BriteCo engagement ring data, 14K settings represented 76.5% of new sales in 2020. By 2025, that dropped to 62.6%. Meanwhile, the share of engagement rings with 18K settings grew by 52.5% during that same time period.(Fig 14)

Given the popularity and growth of lab-grown diamond sales, the market for diamond jewelry has experienced irreversible change. However, it’s important to remember that the fine jewelry industry has been around a very long time, and has survived and even thrived through other rapid and dramatic changes. What happens next? Which of these trends will continue, which will recede, and which will change course? BriteCo makes several predictions about the future of lab-grown and natural diamonds based on data and experience in the industry. Note, these predictions are not meant to be financial advice.

The lab-grown industry has laser-focused on a single message for consumers: lab-grown diamonds are real diamonds and no different from natural diamonds. Meanwhile, the lab-grown producers have produced lab-grown diamonds in massive quantities, flooding the market and sending prices, including natural diamonds, on a steep decline.

The disconnect between rhetoric and price tells a different story. At the current rate, lab-grown diamonds may simply be seen as a rapidly depreciating asset, a cheap imitation of the real thing. Recent action by the Gemological Institute of America (GIA) confirms that lab-grown diamonds are becoming more of a commodity, not to be graded on individual quality scales but in larger commercial groupings.

According to GIA, “Beginning later this year [2025], GIA (the Gemological Institute of America) will start using descriptive terms to characterize the quality of laboratory-grown diamonds and will no longer use the color and clarity nomenclature that GIA developed for natural diamonds….

The revised GIA description system for laboratory-grown diamonds will confirm that the submitted item is a laboratory-grown diamond and whether it falls into one of two categories, ‘premium’ or ‘standard.’”

With more than 10 million people worldwide relying on the diamond mining industry, natural diamond perceptions have made significant progress in the past three decades, focusing on improving the lives of those closest to the mining process. Seeking to put the perception of “blood diamonds” behind it, the industry has repositioned itself to be a greater source of good in some of the poorest parts of the world.

Most recently, the natural diamond industry has accelerated its marketing to consumers. The Natural Diamond Council has a website full of articles and an education center. De Beers, the world’s dominant earth-mined diamond company, is introducing a new “beacon” and brand. In addition, the Antwerp World Diamond Centre and the WFDB have developed their own pro-natural campaigns.

It’s possible lab-grown diamonds won’t be regarded as a luxury item in the future, but that doesn’t mean lab-grown diamonds would be considered on par with fashion or costume jewelry. Instead, a new class of jewelry could emerge. These jewelry items would be made of various precious metals and lab-grown diamonds.

They would be positioned as everyday wear jewelry pieces, featuring diamonds that consumers don’t worry about getting nicked, scratched, dented, and dinged. This new class of diamond jewelry would likely be composed of items such as bracelets, necklaces, earrings, and pendants. (Fig 15)

With the commoditization and extreme price gap between natural diamonds and lab-grown diamonds, consumers might feel that an item so inexpensive cannot be a good representation of lasting love and commitment. Since an engagement ring usually consists of one larger center diamond, consumers may prefer to keep engagement rings natural.

One trend that points to this conclusion is the difference in average carat weight for natural and lab-grown diamonds over time. Like many fads, very large lab-grown rings may be seen as a lower status symbol than smaller natural diamonds. Thus, a higher social status may be attributed to natural diamonds by assuming “if you can afford it, you would choose natural diamonds.”

At the end of 2024, according to BriteCo data, 52.6% of engagement rings sold were with natural diamonds. This has seen a comeback for natural diamonds over the past two quarters of 2025 to 57.3%. While too little data has been collected to identify a clear movement in the market, it could be a sign of an early trend. (Fig 16)

Outside of brown and yellow diamonds, different diamond colors are exceptionally rare and extremely expensive. While natural diamonds do occur in many colors, truly vivid and intense fancy colors are extremely rare and command very high prices. In contrast,

lab-grown diamonds can be produced in vivid colors more consistently and at much less expense. Advances in lab diamond technology enable the creation of diamonds in a broad spectrum of colors — including yellow, blue, pink, green, orange, and even rarer hues like red and purple — with high saturation and vibrancy. This gives consumers many more color options at affordable prices when shopping for lab-grown diamonds, and will likely boost demand in the future. (Fig 17)

Lab-grown diamonds have had one of the most disruptive impacts on the diamond jewelry industry in many years. It’s clear that lab-grown diamonds are here to stay and will influence both industry and consumer buying behaviors in the future. This report from BriteCo has identified key trends based on actual purchase data and has made several predictions about where the market is going. BriteCo will continue to monitor and report on developments in the lab-grown diamond market in order to test its predictions as more data becomes available.

BriteCo is a personal lines insurance agency that specializes in jewelry and wedding insurance. BriteCo policies are backed by Glencar Insurance Company, an AM Best A+-rated carrier, and Hannover Re as an investor and reinsurance partner. The company was formed in 2017 and started writing jewelry policies in 2019. Since then, BriteCo has grown to issue hundreds of thousands of policies and protect billions of dollars worth of jewelry across the US.

In addition to insurance, BriteCo also offers independent retail jewelry partners a state-of-the-art appraisal system. The appraisal system provides an online application that allows jewelers to automate detailed, accurate appraisals in a matter of minutes. It’s a game changer for independent retail stores that typically relied on dated, manual processes involving hand-typed appraisals. The BriteCo appraisal system ensures accuracy by building appraisal price recommendations based on real-time underlying market data. It is the most powerful appraisal tool on the market, used by thousands of jewelers across the US every day.

In addition to providing jewelers with a powerful pricing tool, the underlying data provides BriteCo with unprecedented insights into evolving trends of new jewelry sales.

For this report, BriteCo utilized data from 03/01/2019 through 05/31/2025 to build our analysis. As a data privacy side note, no personal data was employed in creating this analysis. While we have detailed information on each piece, all other personally identifiable information, in accordance with best data practices, has been anonymized.