What to watch out for when looking to protect your Engagement Ring investment

What’s one of the last things most couples worry about when choosing and purchasing an engagement or wedding ring? Insurance. Even though buying an engagement ring might be one of the largest purchases of their lives—after a home mortgage or a car—far too many people make assumptions about protecting their precious possessions that may not be true or accurate. Let’s look at the top five most common mistakes I’ve seen in my 13 years as a retail jeweler helping thousands of couples select and protect their engagement rings.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Mistake # 1 – Not getting engagement ring insurance at all.

It may be hard to believe but research shows that up to 50 percent of engagement ring purchases never get insured. And we are not talking about just less expensive rings. A ValuePenguin survey recently reported that nearly 30 percent of people with jewelry valued in the $5,000 to $10,000 range (the typical cost of an engagement ring) still don’t have any insurance coverage. That’s shocking when you consider how affordable jewelry insurance can be, with annual costs for policies ranging from 0.5% to 2.5% of an engagement ring’s value.

Mistake # 2 – Assuming jewelry warranty is the same as jewelry insurance and your ring is covered.

Here’s the facts: A jewelry warranty is not jewelry insurance. Nor is it meant to be, though many people may feel like that’s all they need to protect their ring. We’re used to buying “extended warranties” for consumer items like appliances and electronics. However, jewelry warranties do not provide full protection in case of loss, theft, or damage.

Jewelry warranties all state their registration terms, what’s covered or not covered, and for how long. You may receive a “warranty card” with your fine jewelry purchase outlining the terms of your jewelry warranty. However, jewelry warranties don’t cover theft, loss, damage, wear and tear, bent or missing prongs, discoloration from outside agents, or bent/misshapen bands. That’s where jewelry insurance comes in. A specialized jewelry insurance policy covers theft, loss, and damage, including what’s known as “mysterious disappearance.” That’s when you don’t exactly know how your jewelry has gone missing.

Needless to say, if you want to be able to fully replace your valuable engagement ring you need specialized jewelry insurance.

Mistake # 3 – Relying on a homeowner’s insurance policy to fully cover a claim

Far too many engagement ring buyers feel their homeowners insurance policy is all they need in the event something happens to their ring. But, the typical homeowner’s insurance policy doesn’t cover the full replacement value of fine jewelry. While a homeowners policy may cover personal possessions, their value is usually capped at $1,000 or $2,000 and subject to a deductible. Even if your homeowners has a separate “floater” or “rider” attached, it won’t cover important perils such as mysterious disappearance (nearly 40% of all jewelry claims).

Some homeowners policies don’t cover natural catastrophes such as hurricanes and earthquakes; a big deal if you live in states like Florida or California. Other policies won’t repair or replace your item. Instead, they’ll offer you the depreciated “actual cash value” of the item—that can leave you seriously short on cash to purchase a new item. Another catch? Making a jewelry claim though your homeowner’s insurance can lead to increased premiums and/or cancellation since those claims go on your record.

Mistake # 4 – Failing to get an appraisal of your engagement ring

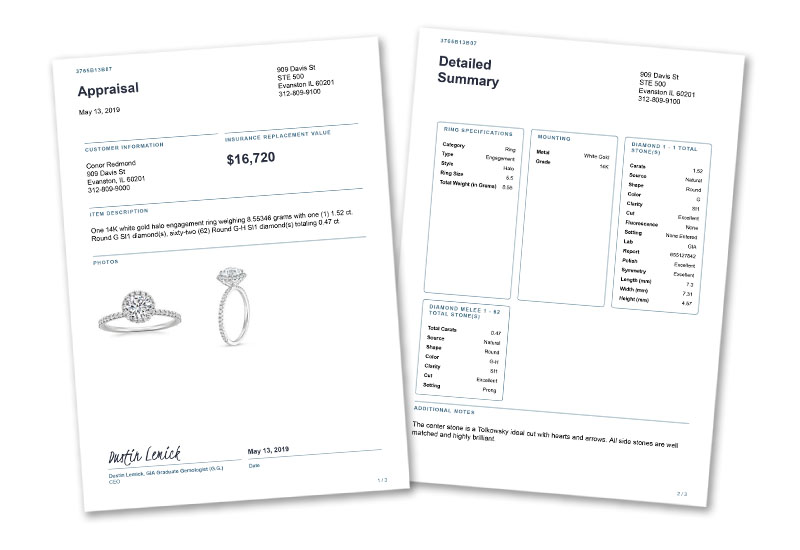

While most people might think a sales receipt for an engagement ring purchase is enough proof of its value, they can be rudely awakened when making a claim, only to find out a detailed jewelry appraisal is required.

A jewelry appraisal verifies the value and key details of your engagement ring. If you are giving or receiving a valuable piece of jewelry, then you need to know its value. Buying a piece of jewelry without an appraisal is like buying a pre-owned vehicle without a CARFAX certificate.

Most jewelry insurance companies require an appraisal to insure your jewelry. Plus, when you know the specific details of your engagement ring and its appraised value, you will get an accurate jewelry insurance quote. Otherwise, you could be underinsuring the piece and having to pay out of pocket costs to replace it, or you could end up overpaying for insurance (year after year) if the appraisal has an inflated value.

Documenting the true value of your diamond engagement ring helps you avoid disputes about the jewelry’s replacement value should you ever need to make an insurance claim. If it’s a new purchase, getting jewelry appraised is also another way to validate your ownership. An appraisal is not expensive with most jewelers charging anywhere from $75-$125 per item.

Mistake # 5 – Neglecting to update insurance coverage over time

I’ve seen it happen a number of times over the years. A woman loses a valuable engagement or eternity ring, goes to make a claim and finds out the value of the ring has appreciated substantially. The problem? Her insurance policy was never updated to reflect the appreciated value. When trying to replace the ring, the amount she is entitled to under her policy doesn’t cover the cost of replacement. She has to make up the difference out of her own pocket.

Most insurance companies recommend a reappraisal of fine jewelry every two to three years. Others, like BriteCo Jewelry and Watch Insurance, have a built-in process to update your appraised value every year upon policy renewal.

Avoid all these mistakes with specialized jewelry insurance

How to avoid these mistakes? It’s pretty simple these days. Look for a specialized jewelry insurance policy to make sure you are fully covered and can replace any lost, stolen, or damaged engagement ring without a major out of pocket expense (no deductible).

Rated the best overall jewelry insurance company by the International Gem Society, BriteCo offers several advantages for consumers looking for engagement ring insurance, eternity ring coverage, and insuring other luxury jewelry items, as well as high value watches. BriteCo jewelry insurance rates, for example, are typically lower than their competitors’ with better coverage.

Policies are rated A+ Superior by AM Best with worldwide coverage for U.S. residents against major perils: loss, damage, theft, and mysterious disappearances. You get zero-deductible, replacement-only policies with low monthly premium payments starting at less than $5/month, and a 5% discount if you pay annually. You also get preventative maintenance included and automatic annual updates to appraised value that keeps your insurance coverage current.

Put your mind at ease and visit BriteCo™ to get your FREE jewelry insurance quote today.