How jewelers can take advantage of new SBA Paycheck Protection and disaster recovery loan programs

April 1st, 2020Here, at BriteCo, we’re trying to do everything we can to support our jeweler partners across the country. Many of our jeweler partners have been asking about the new Paycheck Protection program as well as SBA loans, so we decided to provide you with some up-to-date information to help you navigate this challenging time. Please keep in mind that we are not lawyers or accountants, so we cannot make recommendations on specific tax-related questions. However, we will do our best to connect you with resources to help you and your business.

From what we can tell, there are two main types of relief loans available through the SBA for small businesses that are applicable to most retail jewelry businesses – new Paycheck Protection loans and disaster recovery loans.

What are Paycheck Protection loans versus disaster recovery loans?

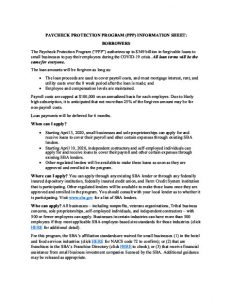

The Paycheck Protection Program is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act just passed by Congress. It provides $350 billion to help American small businesses like retail jewelers with eight weeks of cash-flow assistance through 100 percent federally guaranteed loans.

- A Paycheck Protection loan is up to $10 million and CAN BE eligible for forgiveness. Up to 100% of the loan can be converted into a grant if you adhere to certain specifications. Generally, the loan will be forgiven if you keep your employees on your payroll with much of their salary (hence “payroll protection”).

An Economic Injury Disaster Loan known commonly as the SBA Disaster Loan program specifically serves people affected by natural disasters in the U.S. The SBA is offering disaster loans to small businesses affected by coronavirus and the resulting economic slowdown.

- A disaster recovery loan is up to $2 million with a relatively low interest rate. This is a true loan and will not be eligible for any type of forgiveness.

What are the big differences between the Paycheck Protection loan and an SBA disaster loan?

A Paycheck Protection loan has some key differences that might make it more appealing for retail jewelers compared with an SBA disaster loan.

For the Paycheck Protection loan:

- No personal or business collateral is required. An SBA disaster loan could require you to provide collateral for loan amounts over $25,000.

- Money from a Paycheck Protection loan has be used for a more restrictive set of purposes within a set amount of time. (See the summary chart here). An SBA disaster loan can be used to cover a wider range of operating expenses.

- If you follow the Paycheck Protection loan requirements, your loan can be forgiven. That means you don’t have to pay it back. The SBA disaster loan, in contrast, requires repayment.

Here is a quick comparison of the Paycheck Protection and SBA disaster loans

| ECONOMIC INJURY DISASTER LOAN -7(b) |

PAYCHECK PROTECTION LOAN – 7(a) |

|

|---|---|---|

| How to Apply? | SBA | SBA Approved Bank |

| Loan Amount | Up to 2MM | Up to 10MM |

| Interest Rate | 3.75%- for Profit 2.75 – NFP | 4% |

| Term | No to exceed 30 years | 10 years |

| Eligible for forgiveness? | No | Yes |

| Loan can be used for | Working capital needs (paying fixed debts, payroll, accounts payable, and other bills that cant be paid because of tthe disasters impact) | Payroll, health benefits, salaries, mortgage payments, rent, utilities, iinsurance and other debt service incurred after 2/15/20 |

| Prepayment Penalty | No | No |

How do I apply for a Paycheck Protection or SBA disaster loan?

You have to go through an SBA-approved bank to apply for a Paycheck Protection loan. Many banks are SBA-approved, including Chase and Bank of America, but you can search directly for an approved bank on the SBA website here and here. You can also use the SBA’s Lender Match tool to find a lender.

For an SBA disaster loan, you need to go directly through the SBA to apply which you can do here.

When can I apply for these new SBA loans?

- Starting April 3, 2020, small businesses and sole proprietorships can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

- Starting April 10, 2020, independent contractors and self-employed individuals can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

- Other regulated lenders will be available to make these loans as soon as they are approved and enrolled in the program.

See Paycheck Protection fact sheet and a application form here.

Can I apply for Paycheck Protection and an SBA disaster loan?

Can I apply for Paycheck Protection and an SBA disaster loan?

Yes, but you can’t apply for an SBA disaster loan for the same purpose as the Paycheck Protection Program. In addition, if you apply for an SBA disaster loan, you can also request a $10,000 emergency grant, interest-free. If approved, the SBA will provide the grant within three days. You can apply for the loan and grant here. https://www.sba.gov/funding-programs/disaster-assistance

What do I have to do to get a Paycheck Protection loan forgiven?

The purpose of the Paycheck Protection Program is to, well, protect paychecks. You must commit to maintaining an average monthly number of full-time equivalent employees equal or above the average monthly number of full-time equivalent employees during the previous 1-year period.

In the 8 weeks following your loan signing date, all expenses related to the following can be forgiven:

- Payroll—salary, wage, vacation, parental, family, medical, or sick leave, health benefits

- Mortgage interest—but only if the mortgage was signed before February 15, 2020

- Rent—provided your lease agreement was in effect before February 15, 2020

- Utilities—as long as your service began before February 15, 2020

When submitting your application for loan forgiveness, you’ll have to provide specific documentation to qualify.

Keep in mind: The amount of your loan that can be forgiven will be reduced…

- In proportion to any reduction in the number of employees on your payroll.

- If any employee wages were reduced by more than 25%.

However, if you rehire employees that were previously laid off at the beginning of the period, or restore any decreases in wage or salary that were made at the beginning of the period, you will not be penalized as long as you do this by June 30, 2020.

Note: The information here is based on a bill that runs nearly 900 pages and the SBA still has 30 days to issue official guidance regarding these loans. So be advised that some of the terms outlined here could change.

The US Chamber of Commerce Corona Virus resource page provides an excellent guide to help you navigate through the Payroll Protection loan process. https://www.uschamber.com/coronavirus

What do I need to do to apply for an SBA Disaster Relief Loan?

Apply directly to the SBA – Apply online by filling out the appropriate forms and providing your business’s information. Once you download the forms for your application, check off “economic injury” as your reason for filing. Then follow the instructions and fill in the necessary information. Once you re-upload your application, you can check the status of it at any time by visiting the website.

What you need to provide – Be prepared with some financial information and supporting documentation related to your business, like two to three years of tax returns, last year’s financial statements, a year-to-date financial statement, property leases, and a working knowledge of your business and personal credit score. A full list of supporting documentation can be found at the bottom of your application form.

It takes less than month to get a decision – The average for SBA to issue a Disaster Loan decision is 21 days. Within that time frame, a loan specialist will be in contact with you to figure out the amount and parameters of the SBA disaster loan. Once the loan documents are signed, funds are deposited via ACH within 3 to 5 business days.

Be sure to stay in touch with your SBA loan representative at your local bank and SBA office to get updates on the status of your application. Here are other links that will help you get started. SBA district offices SBA regional offices SBA State Resources

At BriteCo we pledge to keep you informed

Our goal at BriteCo is to keep this information up to date and continue to add useful resources for jewelers as they become available. We sincerely hope this helps! If you have friends, colleagues, or family who might find this useful, please feel free to share it with them. They can also sign up if they’d like to receive our newsletter.

If you have any feedback or ideas for us, please don’t hesitate to drop us a line – on Facebook, through the chat feature on our website, or via email. Hang in there and stay positive.

Can I apply for Paycheck Protection and an SBA disaster loan?

Can I apply for Paycheck Protection and an SBA disaster loan?